The Afridigest Fintech Review is a weekly recap of what happened in African fintech.

Hello again, friends! Remember: this Fintech Review goes out on Sundays and the regular Week in Review goes out on Mondays. If you appreciate our work, upgrade your subscription today.

On to the week’s highlights:

• Zero fintech deals announced this week.

• A quick glance at the story of fintech in Francophone West Africa over the last decade.

• The top tech news of the week globally was SVB’s collapse, but we’ll save our words for tomorrow’s Week in Review. Across Africa, however, the fintech news of the week was Flutterwave’s no-hack hack which we touch on below.

• Companies appearing in today’s Fintech Review: Flutterwave, Clickatell, Taly, Kuda, Cassava Network, Pesapal, Fingo, M-PESA, Ruubby, Stitch, Accrue, & more.

• Executives appearing: Carbon’s Ngozi Dozie, RedCloud’s Justin Floyd, Moniepoint’s Pawel Swiatek, Moniepoint’s Omondi Ochieng, Capital Art’s Karabo Morule, Kashier’s Mohamed Mohsen, Awabah’s Tunji Andrews, Mastecard’s Victor Ndlovu, MagmaTech’s Jacqueline Brondberg Aby, 4G Capital’s Wayne Hennessy-Barrett, Bank of Kigali’s Obinna Ukwuani, & more.

➜ If you’re a free subscriber, you’ll only see a preview below. Upgrade your subscription today.

⭐ Not interested in fintech? No problem: visit the Notifications section of your Account Settings page and deselect the Fintech option.

Week 10 2023: March 5-11

💸 FundraisesWe’ll double check, but looks like no fintech fundraises were announced this week.

💸 Investor ActivityINVESTOR ACTIVITY

Nigeria’s EchoVC formally launched EchoVC Chain, its $8M pilot blockchain-focused seed fund.

EMURGO Africa and Kepple Africa Ventures established a joint venture to invest in African Web3 businesses.

📰 News of the WeekOn February 28th, Fast Forward’s Opeyemi Awoyemi tweeted a thread that included the following:

And on March 3rd, Educare’s Alex Onyia shared the following:

In last Sunday’s Fintech Review, I shared news reports that hackers reportedly stole over $6M from Flutterwave accounts — and I clarified that “I heard this was from merchant accounts, not Flutterwave itself.”

That same day, Flutterwave released a blog post saying that “Flutterwave has not been hacked.”

The statement continued, “some users … might have been susceptible,” but “no user lost any funds … [as we] were able to address the issue before any harm could be done.”

But days later TechCabal published an article that included “court documents [that] raise questions about Flutterwave’s version of events.”

Those documents, dated February 20, 2023, show Flutterwave “asked for police assistance to recover funds by obtaining court orders … to sustain account freezes on 107 accounts in 27 banks that allegedly received money from illegal transfers from Flutterwave accounts,” and some or all of those account freezes were apparently granted.

Anger at the account freezes, coupled with Flutterwave’s lack of transparency in its statement, led to the hashtag #flutterwavescam trending on Twitter on Friday and Saturday in Nigeria.

Meanwhile, amidst the furor from those with funds frozen & others, media platforms reported that Flutterwave’s CEO bought a “luxurious” Miami beach home for $7.1M.

And apparently, despite the hack that wasn’t, Flutterwave’s CEO quietly began leading an effort to tackle fraud in Nigerian fintech.

Ultimately, one wonders if the communications here could have been handled more effectively…

🚀 Partnerships & Product LaunchesLAUNCHES

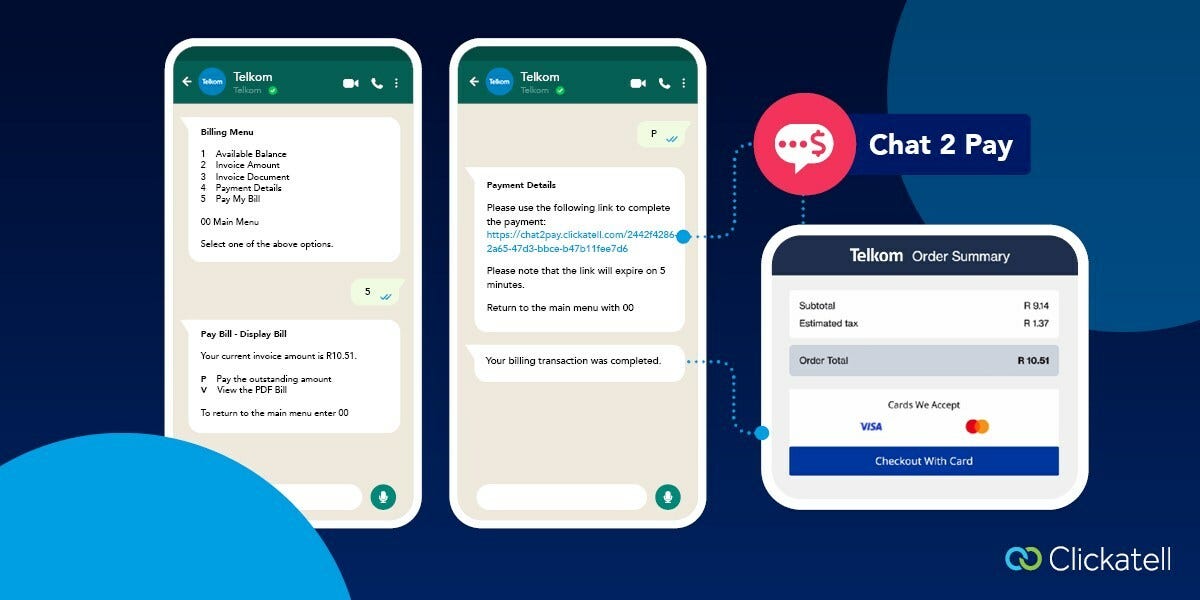

Telkom launched WhatsApp payments in South Africa powered by conversational commerce platform Clickatell. Telkom customers in the country can now pay phone bills and buy telco packages via WhatsApp using Clickatell’s Chat2Pay product. For more on Clickatell, see Week 8 2022’s Week in Review where its $91M Series C was the deal of the week.

Banque du Caire launched its 99.99%-owned e-payments platform Taly in Egypt. Taly offers omnichannel payment acceptance and cash management solutions, real-time family card monitoring & control solutions, and buy-now-pay-later (BNPL) management solutions for banks and fintechs.

Nigerian digital bank Kuda launched its SoftPOS product. Kuda Business users with NFC-enabled smartphone can now accept EMV card payments. For more on SoftPOS, see the article ‘SoftPOS is ready for prime time’ in Week 2 2023’s Fintech Review.