Afridigest is your intelligent guide to Africa’s tech ecosystem. The Fintech Review is a weekly recap of what matters in African fintech.

Hello again, friends! Remember: this Fintech Review goes out on Sundays and the regular Week in Review goes out on Mondays.

On to the week’s highlights:

• Three fintech fundraises were announced across the continent.

• News of the week: Issues with virtual USD cards resurfaced after last year’s experience. A new report finds that Africa will be the fastest-growing fintech market worldwide this decade. Nigeria moved towards a ‘Blockchain-powered economy.’ One Nigerian fintech announced that it processed a whopping $43 billion in Q1 2023. And Kenya’s President Ruto supported the launch of a youth-focused neobank.

• Companies appearing in today’s Fintech Review: Nomba, Fedi, Nkwa, Moniepoint, Fingo, Union54, Vesicash, egabi FSI, ComiBlock, Mastercard, Aladdin, & more.

• Executives appearing: Eversend’s Stone Atwine, Union54’s Perseus Mlambo, Chipper Cash’s Ham Serunjogi, FairMoney’s Laurin Hainy, Affinity’s Tarek Mouganie, GetEquity’s Jude Dike, Paymob’s Mostafa Menessy, MFS Africa’s Gwera Kiwana, EBANX’s Wiza Jalakasi, Ukheshe’s Mark Dankworth, Cellulant Nigeria’s Ibrahim Aminu, BankServAfrica’s Mpho Sadiki, Ozow’s Lyle Eckstein & Gary Stone, Mastercard’s Gabriel Swanepoel, Capitec’s Busi Radebe, & more.

➜ If you appreciate our work, show your love by upgrading your subscription. If you’re a free subscriber, you’ll only see a preview of this Fintech Review below.

⭐ Not interested in fintech? No problem: visit the Notifications section of your Account Settings page and deselect the Fintech option.

A MESSAGE FROM AFRICREATEIntelligence you can trust.

Africreate is a trusted research & advisory firm that offers customized intelligence-led solutions including:

Custom Research, Analysis, & Advisory for Bespoke Projects

Training, Executive Education, & Corporate Innovation Solutions

Strategic Communication & Thought Leadership Services

Week 18 2023: April 30 - May 6

💸 FundraisesNomba, a Nigerian omnichannel payment platform, raised a $30M pre-Series B.

Fedi, a Nigerian/American developer of blockchain-powered, community-focused financial and data technology, raised a $17M Series A.

Nkwa, a Cameroonian savings platform, raised $15K.

📰 News of the WeekAside from Nigerian soonicorn Moniepoint’s announcement that it processed $43B in the first quarter of this year, the fintech news of the week largely revolved around virtual USD cards. (Again.)

What happened? A number of fintechs in Nigeria (but not all) ‘temporarily deactivated’ their virtual dollar card offerings.

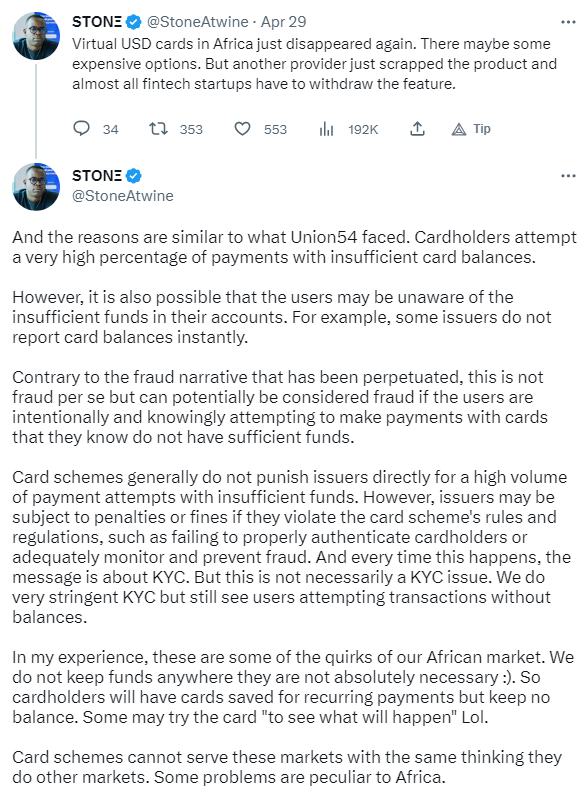

Why? Well apparently, a major provider cut the cord. Here’s Eversend CEO Stone Atwine on the matter:

MFS Africa’s Crypto Founder in Residence, Gwera Kiwana, added a bit of color on the underlying customer behavior in this thread:

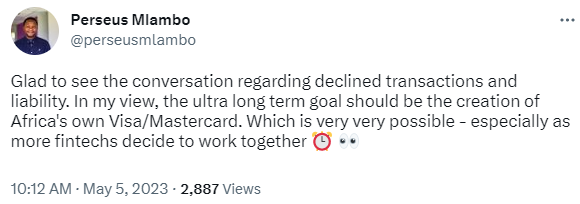

What’s the long-term solution? Maybe a card scheme for Africa? Here’s Union54’s CEO:

🚀 Partnerships & Product LaunchesLAUNCHES

Safaricom launched Fuliza ya Biashara, an extension of its Fuliza consumer credit overdraft facility that targets SMEs. The service allows businesses to borrow up to 400,000 Ksh (~$3,000) via M-Pesa.

The new offering is seen by some as a challenge to Kenya’s commercial lending sector, and now’s a good time to (re-)read Wiza Jalakasi’s old essay, ‘How banks are becoming telcos and telcos are becoming banks in Africa.’