Afridigest is your intelligent guide to Africa’s tech ecosystem. The Fintech Review is a weekly recap of what matters in African fintech.

On to the week’s highlights:

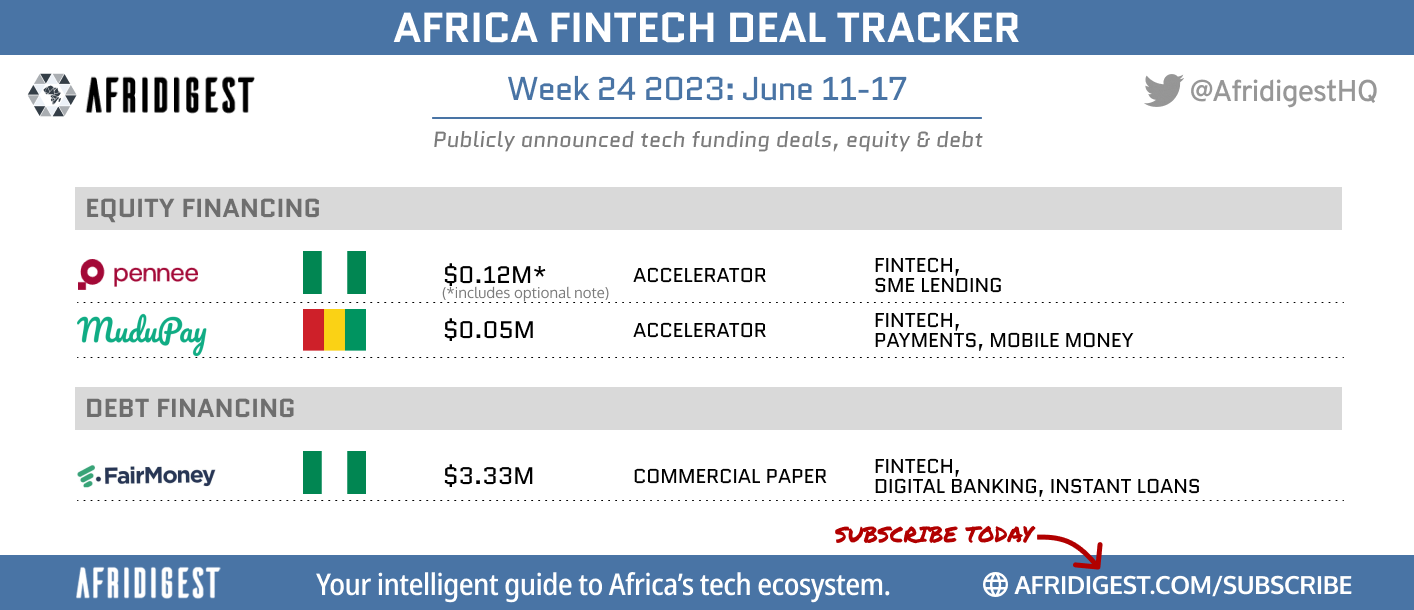

• Two equity fundraises from accelerator programs and one debt fundraise.

• News of the week: Fintech M&A is poised to pick up in the second half of the year as Moniepoint, Zepz, and others are actively evaluating targets. Visa continues to deliver on its $1 billion Africa pledge. And Nigeria’s removed its currency peg — a move with a big impact on fintech startups in the country.

• Companies appearing in today’s Fintech Review: Pennee, MuduPay, FairMoney, Pezesha, Network International, aYo Holdings, Gamp, Eyowo, Mazzuma, VodaPay, DoshFX, Zepz, Moniepoint, Interswitch, Flutterwave, Baxi & more.

• Executives appearing: Safaricom’s Peter Ndegwa, Baxi’s Mxolisi Msutwana, Mojaloop Foundation’s Paula Hunter, Jia’s Zach Marks, OPay’s Olu Akanmu, Visa’s Alfred F. Kelly, Jr., & more.

➜ This Fintech Review is available to premium subscribers of Afridigest — if you’re a free reader, you’ll only see a limited preview below. Remember to subscribe before June 22nd.

⭐ Not interested in fintech? No problem: visit the Notifications section of your Account Settings page and deselect the Fintech option.

A MESSAGE FROM AFRICREATEIntelligence you can trust.

Africreate is a trusted research & advisory firm that offers customized intelligence-led solutions including:

Custom Research, Analysis, & Advisory for Bespoke Projects

Training, Executive Education, & Corporate Innovation Solutions

Strategic Communication & Thought Leadership Services

Week 24 2023: June 11-17

📰 News of the WeekLast December, just over a year after Google announced its commitment to invest $1 billion in Africa over five years, global payments provider Visa announced its own pledge to invest $1 billion in the continent through 2027.

This week, Visa announced its latest initiative in that vein — the Visa Africa Fintech Accelerator which will work with 40 African fintechs each year for the next five years and invest in a third of them. (Applications open next month.)

Here’s a video worth watching of Visa’s Executive Chairman Alfred F. Kelly, Jr. on fintech in Africa from the 2023 Bloomberg New Economy Gateway Africa event in Morocco last week (22 minutes):

Bloomberg's Erik Schatzker: I know your expansion here is not a short-term play. How long do you figure before Visa's business on this continent accounts for a meaningful share of the company's growth?

Kelly: Oh, I think probably a decade. We’ll see. But what I say about Africa is that we’re going to invest heavily over the next five years so that, in essence, over the decade after that this starts to become a very meaningful piece of our business.

And here’s a quick look at Visa’s Africa strategy to date:

Visa’s equity investments include Nigeria’s Paystack, Interswitch, and Flutterwave; South Africa’s Jumo, and Sudan’s Bloom.

The company has also opened ten local offices across the continent in South Africa, Kenya, Nigeria, Ethiopia, Sudan, DRC, and elsewhere.

And it’s launched a variety of initiatives including an innovation studio in Nairobi (its first in sub-Saharan Africa), the She’s Next initiative in Africa, the Visa Everywhere Initiative, AWIF support, and more.

It’s worth keeping an eye on Visa’s approach to fintech & crypto in Africa going forward.

✨ The rest of this newsletter is only available to premium members of Afridigest, whose support makes this work possible. If you’re not already a premium member, consider upgrading your subscription for access to the details below on fundraises, product launches, partnership announcements, and curated fintech news. Remember: subscription pricing will go up on June 22nd.✨