Afridigest is your intelligent guide to Africa’s tech ecosystem. The Fintech Review is a weekly recap of what matters in African fintech.

On to the week’s fintech highlights:

• One equity fundraise and one debt fundraise were announced this week.

• News of the week: Zambian debit card issuing platform Union54 announced its pivot into the super app space. Mobile money unicorn Wave appeared on the list of top Y Combinator companies by revenue. Ethiopia’s Telebirr launched four new digital financial services.

• Companies appearing in today’s Fintech Review: Mazzuma, Mogo, PalmPay, Union54, SecondSTAX, TerraPay, Sendwave, Wave, Mukuru, Eyowo, SoLo Funds, & others.

• Executives appearing: PayM8’s Andrew Springate, Jawudi’s Rahim Diallo, Axalio’s John Lombela, Kora’s Enyioma Madubuike, Nclude’s Basil Moftah, & more.

➜ This Fintech Review is available in full to premium subscribers of Afridigest — if you’re a free reader, you’ll see a limited preview below.

⭐ Not interested in fintech? No problem: visit the Notifications section of your Account Settings page and deselect the Fintech option.

Week 26 2023: June 25 - July 1

📰 News of the WeekThere’s a new player in Africa’s super app race.

This week, Zambian debit card issuing platform Union54 announced that it’s launching a new messaging-led super app/social commerce platform called ChitChat later this year.

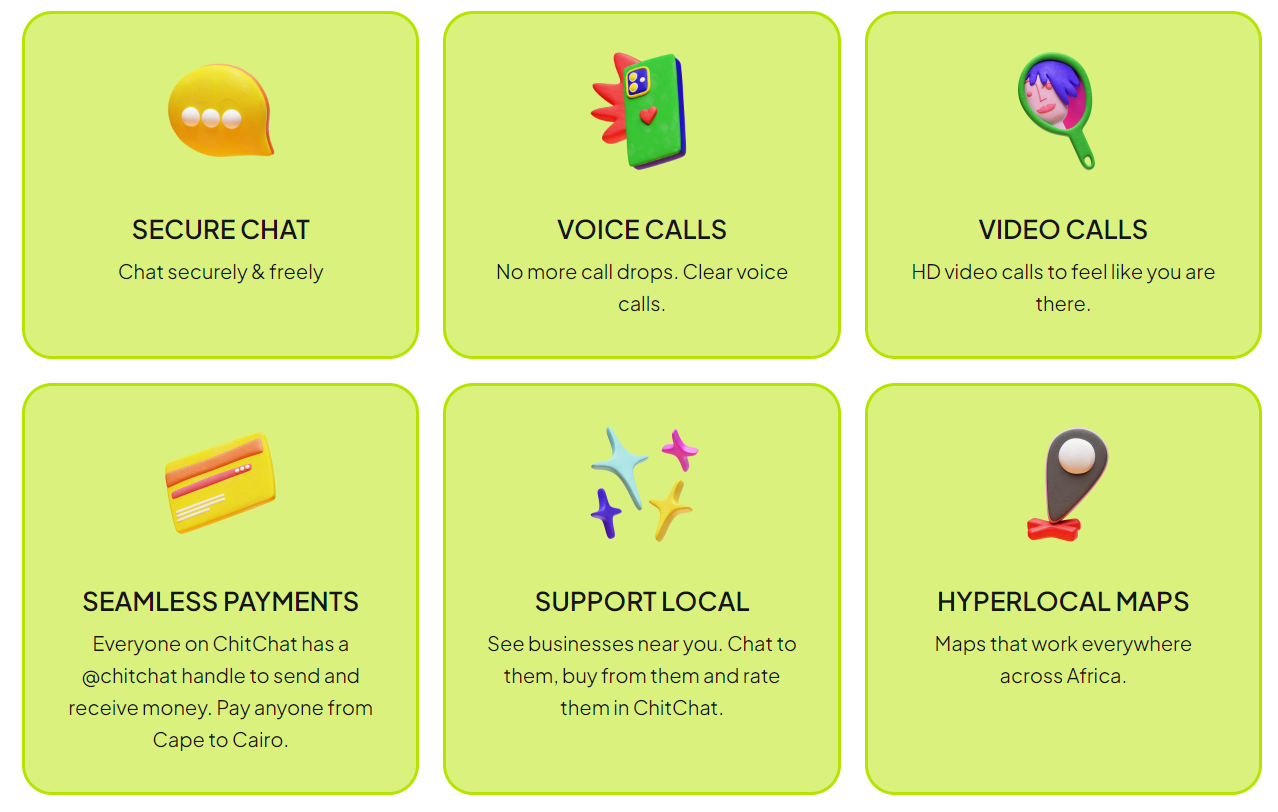

Like WhatsApp, the platform will couple text-based chat functionality with voice & video calls, but will also offer embedded payments for peer-to-peer transfers and local commerce (paired with dollar-based virtual cards developed in partnership with Mastercard).

Over time, the company also plans to roll out gaming, dating, and food delivery services.

It’s a surprising development for the card-issuing platform that answers the question ‘what’s up with Union54?’ since its operational issues almost exactly a year ago.

And one aspect of the new endeavor worth highlighting here is the planned ownership structure.

According to Bloomberg, the company plans to retain just 40% ownership while sharing equity with “local companies,” presumably local partners, in the markets it operates in.

While conversational commerce is gaining ground in Africa, particularly in South Africa, the jury remains out for messaging-led super apps that compete with WhatsApp more directly.

Pair with: How Africa’s super app landscape is evolvingElsewhere in Africa’s super app landscape this week, PalmPay announced that it now has an ecosystem of 25 million users, 500,000 mobile money agents, and 300,000 merchants. And it says it now processes $5 billion (N3.7 trillion) monthly.

Oh, and in case you missed it, the company is apparently building a “very, very super app” of its own. 🤭

✨ The rest of this newsletter is only available to premium members of Afridigest, whose support makes this work possible. If you’re not already a premium member, consider upgrading your subscription for access to the details below on product launches, partnership announcements, curated fintech news, and more.✨