Afridigest Fintech Review: Merchant acquiring is having a moment

Week 31 2023: July 30 - Aug 5

Afridigest is your intelligent guide to Africa’s tech ecosystem. The Fintech Review is a weekly recap of what matters in African fintech.

On to the week’s fintech highlights:

• Four fintech fundraises were announced this week.

• News of the week: Payments unicorn OPay repeatedly appeared in the headlines. Its widely respected Nigeria CEO stepped down, it appointed a new Nigeria MD with ties to the country’s Central Bank, and it announced its intent to apply for a digital banking license in Egypt.

• Companies appearing in today’s Fintech Review: Traction, Emtech, SuiTch, Patricia, Verve, Meeza, TerraPay, Lipa Later, Bankly, Wave, OPay & more.

• Executives appearing: Jumo’s Joseph Mucheru, Asaak’s Kaivan Sattar, Level Finance’s Raeesa Gabriels, Numida’s Ana Grajales, Moniepoint’s Tosin Eniolorunda, Visa’s Miranda Perumal, Chipper Cash’s Ham Serunjogi, Djamo’s Hassan Bourgi, Afropolitan’s Eche Emole, Yellow Card’s Jason Marshall, & more.

➜ This Fintech Review is available in full to premium subscribers of Afridigest — if you’re a free reader, you’ll see a limited preview.

⭐ Not interested in fintech? No problem: visit the Notifications section of your Account Settings page and deselect the Fintech option.

Week 31 2023: July 30 - Aug 5

📰 Thoughts of the WeekICYMI: Visa and Mastercard just reported earnings.

Visa brought in $8.1B in revenue for the quarter with 51% of that hitting the bottom line. And Mastercard brought in $6.3B with a 45% net profit margin.

The two payment behemoths are among the world’s most profitable companies, and various players are salivating at the opportunity to steal a larger piece of the payments pie.

For almost a decade there’s been talk of digital wallets disintermediating the Visa-Mastercard duopoly, but that hasn’t (yet?) materialized.

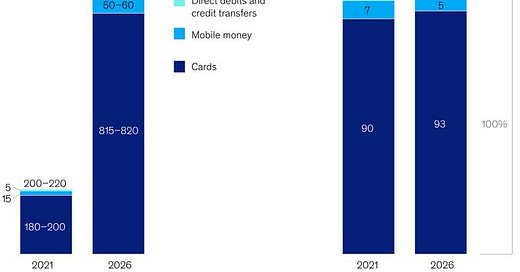

But other players in the market that fly somewhat under the radar are worth paying more attention to: domestic card schemes.

Compared to international card schemes, domestic networks are cheaper, closer to local consumers & merchants, and have greater flexibility to innovate around market-specific needs.

And with Visa and Mastercard recently pulling out of Russia due to sanctions, domestic payments sovereignty is seen as an increasingly important consideration too.

So, it’s perhaps not too surprising that domestic card schemes seem to be on the rise across the world.

And here in Africa, the Central Bank of Nigeria launched its AfriGo scheme just this January.

Other domestic card schemes across the continent include Nigeria's Verve, Egypt's Meeza, and Angola's Multicaixa.

We’ll publish a bit more about domestic card schemes in Africa soon, so please reach out if there’s something I should know (or something you want to know) or if you have an interesting perspective to share. 🙏🏽

✨ The rest of this newsletter is available to premium subscribers of Afridigest, whose support makes this work possible. If you’re a free reader, consider upgrading your subscription today. Join a discerning group of founders, investors, and executives from leading organizations who enjoy subscriber benefits by supporting Afridigest.✨