Afridigest is your intelligent guide to Africa’s tech ecosystem. The Fintech Review is a weekly recap of what matters in African fintech.

On to the week’s fintech highlights:

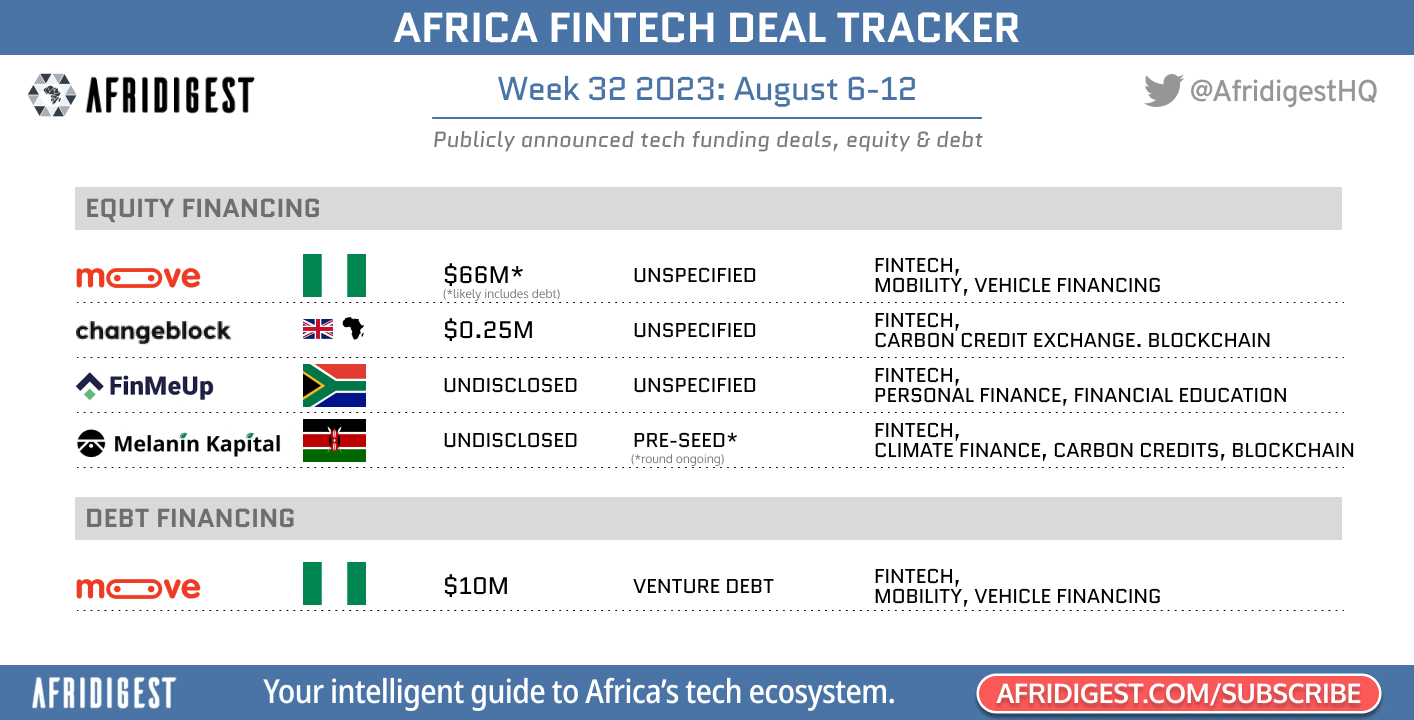

• Five fintech-related fundraises were announced this week.

• News of the week: The assets of Ghanaian fintech Dash are being sold after fraud was discovered. And the Nigerian stock exchange announced that it’s developing a dollar settlement platform for tech startups.

• Companies appearing in today’s Fintech Review: Moove, Changeblock, FinMeUp, Melanin Kapital, Inclusivity Solutions, PaySky, SeerBit, Fincra, Spleet, Airtel Money, Goldfinch, & more.

• Executives appearing: Cellulant co-founder Ken Njoroge, Shyft’s Arno von Helden, Cashlinq’s Tendai Mugovi, Pastel’s Abuzar Royesh, eTranzact Ghana’s John Obeng Apea, Remita’s Mujib Ishola, & more.

➜ This Fintech Review is available in full to premium subscribers of Afridigest — if you’re a free reader, you’ll see a limited preview.

⭐ Not interested in fintech? No problem: visit the Notifications section of your Account Settings page and deselect the Fintech option.

Week 32 2023: Aug 6-12

📰 Thoughts of the WeekHere’s what we learned this week.

The app in question? Ghanaian digital wallet & unified payments network Dash.

Back in Week 7, the news broke that Prince Boakye Boampong, the company’s Founder and CEO, allegedly engaged in ‘financial misreporting’ and was thus placed on ‘indefinite administrative leave’ pending a forensic financial audit.

That audit was initially expected to be completed within a month or two, but nothing was made known to the public since then — until last Thursday.

Sources told Henry Nzekwe over at Weetracker that the investigation “revealed the numbers and transaction volumes that once touted the company's meteoric rise were elaborate fabrications intended to mislead investors.”

Said differently:

And the company is now apparently being sold for parts.

Some questions:

Given the founder’s windfall here, how amenable will investors be to founder secondaries in the future?

In light of this, is it fair to question how (foreign) investors do due diligence?

And what are the broader implications?

The Dash transaction was Insight Partners’ first lead investment in Africa — how excited will they be about future opportunities across the continent? And what will they say to others about their African excursion?

And how about Jitendra Gupta of Indian neobank Jupiter who decided to invest within 20 minutes of talking to the founder, per his tweet above?

I won’t belabor the point. But if you want more thoughts on this, I’d point you to

‘s February essay, ‘On diligence, Dash, & deception.’And the last word here goes to Paystack’s Ezra Olubi:

✨ The rest of this newsletter is available to premium subscribers of Afridigest, whose support makes this work possible. If you’re a free reader, consider upgrading your subscription today. Join a discerning group of founders, investors, and executives from leading organizations who enjoy subscriber benefits by supporting Afridigest.✨