Afridigest is your intelligent guide to Africa’s tech ecosystem. The Fintech Review is a weekly recap of what matters in African fintech.

On to the week’s fintech highlights:

• Seven fintech fundraises and one acquisition were announced this week.

• News of the week: Flutterwave announced a bunch of new senior hires, keeping talks of a potential IPO alive. Moove hired its first-ever CFO in a sign of its maturity & stage of growth. And Chipper Cash laid off a small number of staff in offices outside of Africa.

• Companies appearing in today’s Fintech Review: Clickatell, Vendy, LemFi, Visa, Earnipay, Onboard, Africred, Nomba, Chipper Cash, and more.

• Executives appearing: Jamii.one’s Charlotte Rønje, Sasai Fintech’s Darlington T. Mandivenga, GSMA Intelligence’s Kalvin Bahai, Union54’s Perseus Mlambo, Chipper Cash’s Samee Zahid, and more.

With that said, let’s get into it!

Note: Premium subscribers have exclusive access to the paid version of this Fintech Review which includes additional details on fintech fundraises, product launches, new partnerships announced, and other paywalled content. Become a premium subscriber for access:

Week 50 2023: Dec 10-16

Seven fintech fundraises and one M&A transaction were announced across Africa this week.

Become a paid subscriber for access to comprehensive tracking of Africa Tech fundraising and M&A deals every week and more.

💸 Equity Deals[Available in the premium version of this newsletter.]

💰 Debt Deals[Available in the premium version of this newsletter.]

🤝🏽 M&A[Available in the premium version of this newsletter.]

📰 News of the WeekAcross certain emerging markets, more & more innovators are building products & services on top of WhatsApp.

That’s due, unsurprisingly, to the platform’s dominance in certain geographies.

Across Africa, some popular apps in this category (broadly speaking) include:

Jem — helps companies send payslips & critical communications to employees using WhatsApp

Foondamate — helps students learn with a WhatsApp study buddy

Catlog — helps vendors create catalogs to sell products via WhatsApp

Several banks across Africa have embraced WhatsApp banking as well.

But this week brought a reminder of other financial services opportunities on the platform — beyond ‘traditional’ WhatsApp banking.

In South Africa, mobile engagement & conversational commerce platform Clickatell announced a partnership with Indian digital lending and alternative credit scoring platform Yabx that will see Yabx launch a WhatsApp Lending product.

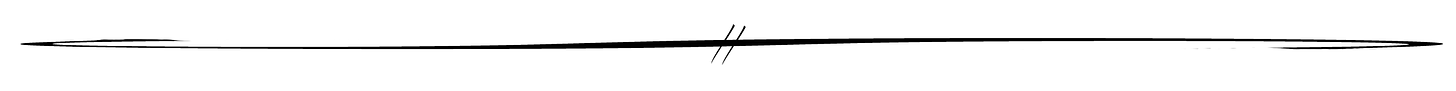

And in Nigeria, Vendy launched a new product that allows businesses to collect payments via WhatsApp.

This seems to be a business pivot for Vendy by the way, not just a new product line.

The YC-backed company initially focused on USSD-powered offline payments (I wrote about it on LinkedIn here), but seems to have now pivoted completely to chat-based payments on WhatsApp.

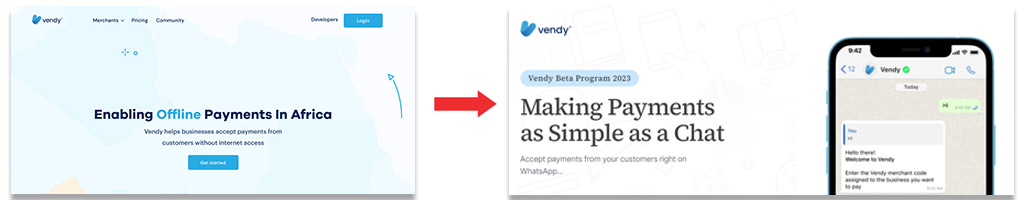

In any case, companies building on WhatsApp is a “core theme” for at least one international VC fund today.

And I wonder how investors across Africa are thinking about this opportunity — both in general and for financial services in particular.

🚀 Partnerships & Product LaunchesPARTNERSHIPS

[Available in the premium version of this newsletter.]

LAUNCHES

Nigerian earned wage access platform Earnipay launched payroll product, Payroll by Earnipay.

Pair with: Earned wage access, explained

[Additional launch announcements available in the premium version of this newsletter.]

📑 Reads of the Week [Available in the premium version of this newsletter.]

🙈 Visual of the weekAustralia and Sweden have the highest adoption rates of BNPL globally.

And across Africa, Egypt and Tunisia lead the way in adoption, according to one study.

Other African countries with notable BNPL adoption include South Africa, Nigeria, Kenya, and Ghana, followed by Angola and Madagascar.

📜 Other News, Reads, and MediaNEWS

Nigerian payments unicorn Flutterwave hired various senior leaders from Paypal, Stripe, Western Union, etc. This comes just over a month after the exit of Oneal Bhambani from the CFO role and is widely seen as strengthening the team ahead of a potential IPO.

Nigerian vehicle financing ‘mobility fintech’ Moove hired the CFO of Brazilian lending unicorn Creditas as its first Chief Financial Officer. This serves as an indication of Moove’s maturity and growing IPO ambitions.

Pan-African fintech platform Chipper Cash laid off a small number of staff outside of Africa & slashed the salaries of its remaining foreign workers. This is reminiscent of Paystack’s announcement a month ago that it was laying off employees across the UAE & Europe to “localize costs.”

EXPANSION & LICENSING NEWS

[Available in the premium version of this newsletter.]

MEDIA INTERVIEWS & REPORTS

How Nigeria’s Nomba is providing point-of-sale, agency banking and payment solutions to merchants across Africa (Afrobility - podcast - 1h 36m)

[Additional media highlights available in the premium version of this newsletter.]

OTHER AFRICA FINTECH READS OF THE WEEK

[Available in the premium version of this newsletter.]

🐤 Tweets of the Week Despite our daily diet of digitization, cash is still very much king:

MADE IN NIGERIA 🇳🇬 WITH 💚

Thanks for reading Afridigest 💌

Tell me what you thought of today’s newsletter:

😡 Hated it • 😑 Meh • 😃 Loved it

Here’s what you can do now:

Share this with a friend using your referral link.

Consider becoming a paying subscriber to read the premium version.