Afridigest is your intelligent guide to Africa’s tech ecosystem. The Fintech Review is a weekly recap of what matters in African fintech.

Merry Christmas, folks 🎅🏻 🎄

On to the week’s fintech highlights:

• Two fintech fundraises were announced this week.

• News of the week: Nigerian banks and fintechs are collaborating to launch a naira stablecoin (cNGN) in 2024. The Central Bank of Nigeria lifted a crypto ban that had been in place since February 2021. And despite erroneous news reports last week, M-PESA is *not* launching physical debit cards.

• Companies appearing in today’s Fintech Review: Bloc, Mastercard, M-Pesa, Chipper Cash, Pezesha, Marketforce, Duplo, and others.

• Executives appearing: Halal’s Ibrahim Lukman, Onafriq’s Funmi Dele-Giwa, Hipipo’s Innocent Kawoya, Carbon’s Chijioke Dozie, Mono’s Abdul Hassan, Nestcoin/Onboard Wallet’s

Yele Bademosi, Rise’s Eke Urum, Emmanuel Njoku, Olaoluwa Samuel-Biyi, Kenn Abuya, Victor Asemota, Osikhena Dirisu, Olumide Adesina, and others.

With that said, let’s get into it!

Note: Premium subscribers have exclusive access to the paid version of this Fintech Review which includes additional details on fintech fundraises, product launches, new partnerships announced, and other paywalled content. Become a premium subscriber for access:

Week 51 2023: Dec 17-23

Two fintech fundraises were announced across Africa this week with $3M+ in disclosed funding raised.

Become a paid subscriber for access to comprehensive tracking of Africa Tech fundraising and M&A deals every week and more.

💸 Equity Deals[Available in the premium version of this newsletter.]

💰 Debt Deals[Available in the premium version of this newsletter.]

📰 News of the WeekOne thing from Kenya & one thing from Nigeria.

KENYA

Many news outlets erroneously reported this week that M-Pesa was rolling out physical debit cards.

And it probably all stems from a now-corrected article from TechCabal’s Kenn Abuya and a misinterpretation of M-Pesa’s announcement in this thread.

Two things: 1) Even a whole M-Pesa can afford to communicate a bit more clearly, and 2) To paraphrase a common quote, “An inaccuracy can travel around the world and back again before the truth gets its boots on.”

NIGERIA

In other major African fintech news this week, the Central Bank of Nigeria lifted its ban on crypto and is now focused on “regulat[ing] such activities.”

As Reuters reports, “The latest guidelines spell out how banks and financial institutions (FI) should open accounts, provide designated settlement accounts and settlement services, and act as channels for forex inflows and trade for firms transacting in crypto assets.”

Some responses from practitioners:

And then there was this from Emmanuel Njoku, former CEO of now-defunct Nigerian crypto payment gateway Lazerpay:

(You’ll recall his interview earlier this year where he pointed to the regulatory environment around crypto in Nigeria as a key contributor to Lazerpay’s shutdown, saying, “The regulatory framework around crypto in Nigeria, which was our core market, was not clear at all, and these enterprise businesses don’t want to put their business in harm or at the mercy of the Central Bank because they wanted to add crypto to their offerings. So that was the problem, and we realized that late.”)

To learn more about the end of the crypto ban in Nigeria via Twitter, I’d recommend threads from:

🚀 Partnerships & Product LaunchesLAUNCHES & PARTNERSHIPS

Nigerian all-in-one fintech infrastructure and banking-as-a-service provider Bloc officially announced the launch its business banking product (again?)

[Additional announcements available in the premium version of this newsletter.]

📑 Reads of the Week [Available in the premium version of this newsletter.]

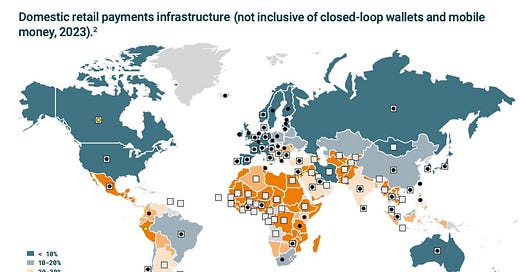

🙈 Visual of the weekHere’s a map of the deployments of card payment & fast payment infrastructure worldwide.

I’m not 100% sure what the colors here mean, but one takeaway is that Africa leads the world in payments processed on domestic retail payment infrastructure.

How do you read it?

📜 Other News, Reads, and MediaNEWS

Nigerian banks and fintechs are collaborating to launch a naira stablecoin (cNGN) in 2024.

[Additional news items available in the premium version of this newsletter.]

MEDIA INTERVIEWS & REPORTS

Ibrahim Lukman, Founder & CEO of Nigerian zero-interest digital bank Halal, on the future of Sharia-compliant banking (WebTV Nigeria - video - 23 mins)

[Additional media highlights available in the premium version of this newsletter.]

🐤 Tweets of the Week Some feedback for investors:

Why is there a cash shortage in Nigeria? Here’s one theory:

Is there credit in Africa?

Bonus: One Nigerian fintech founder takes issue with recent media coverage of his company in this thread.

🗣️ Community Corner and Opportunities (Send to submissions@afridigest.com)Nigerian B2B payments platform Duplo is hiring a Head of Payments to drive partnerships & go-to-market strategy.

MADE IN NIGERIA 🇳🇬 WITH 💚

Thanks for reading Afridigest 💌

Tell me what you thought of today’s newsletter:

😡 Hated it • 😑 Meh • 😃 Loved it

Here’s what you can do now:

Share this with a friend using your referral link.

Consider sliding down my chimney by becoming a paying subscriber which gives you access to the premium version.