The Afridigest Fintech Review is a weekly recap of what happened in African fintech.

Hello again, friends! Remember: this Fintech Review goes out on Sundays and the regular Week in Review goes out on Mondays.

On to the week’s highlights:

• Five fintech/fintech-adjacent deals were announced with $43M in disclosed equity raised.

• Fintech news worth noting: Nigeria’s Payday has 89K MAUs; Nigeria’s Flutterwave recovered the $50M that Kenya froze; Ghanaian fintech darling Dash placed its Founder/CEO on administrative leave pending an investigation (but there’s already a lot of reputational damage); 'Massive' layoffs happened at pan-African unicorn Chipper Cash; Ethiopia continues its reputation of being unfriendly to foreign fintechs; and there was a shedload of partnership announcements.

• Companies appearing in today’s Fintech Review: Smile Identity, Naked Insurance, Curacel, Power Financial Wellness, Dillali, Fonbnk, Fluidcoins, Vantage Payment System, Payday, Gozem, ThankUCash, Ezra, Julaya, EasyEquities, Root, Yabx, DPO Group, Unchorlight Kenya, Lami, NowNow, Tingo, Flutterwave, Chipper Cash, Dash, Djamo, & more.

• Executives appearing: Branch International’s Dayo Ademola, Payday’s Favour Ori, Ladda/Money Africa’s Adedayo Bakare, Blockfinex’s Danny Oyekan, Founder Factory Africa’s Andy Obuoforibo, Backbase's Emmanuel Onyeje, Dash’s Prince Boakye Boampong, OnePipe’s Ope Adeoye, FlexID’s Victor Mapunga, Kippa’s Kennedy Ekezie-Joseph, Pezesha’s Hilda Moraa, Flex Finance’s Yemi Olulana, & more.

If you’re a free subscriber, you’ll only see a preview of this Fintech Review. Remember to upgrade your subscription or start a trial to read it in full. ➜ And for the first time, annual subscriptions can be paid for in Nigerian naira via Paystack here.

⭐ Not interested in fintech? No problem: visit the Notifications section of your Account Settings page and deselect the Fintech option.

Week 7 2023: February 12-18

💸 FundraisesFINTECH & FINTECH-ADJACENT FUNDRAISES

🇳🇬 Smile Identity, a British/Nigerian identity verification & digital KYC platform, raised a $20M Series B.

🇿🇦 Naked Insurance, a South African digital insurance platform that helps consumers insure their cars and homes, raised a $17M Series B.

🇳🇬 Curacel, a Nigerian API insurance infrastructure & embedded insurtech provider, raised a $3M seed round.

🇰🇪 Power Financial Wellness, a Kenyan employee financial wellness platform offering credit, savings, investment, insurance, and earned wage access solutions, raised a $3M seed round.

🇳🇬 Dillali, a Nigerian financial bookkeeping platform, raised an undisclosed bridge round.

🤝🏻 Mergers & Acquisitions

Crypto exchange Blockfinex acquired Nigerian B2B crypto infrastructure provider, Fluidcoins for an undisclosed sum in a distressed sale.

Africa-focused payments service provider Cross Switch acquired a 50% stake in Moroccan payments platform Vantage Payment Systems, a subsidiary of Moroccan holding company Equity Invest.

💡 Executive Insights: Clearly define your target market.A lot of attention has been paid to 'banking the unbanked' across Africa. But many are banked and still underserved — a ripe segment for neobank offerings.

Pair with: A discussion on financial inclusion in Nigeria with the MD of Branch International (video)

🚀 Partnerships & Product LaunchesLAUNCHES

Web3 on-/off-ramp Fonbnk which converts airtime credits into digital money launched its Instant Merchant product. Creators can now instantly generate links to receive USDC payments and their supporters/buyers can use those links to pay via prepaid airtime.

@JasonNjoku - we have 150k+ registered Nigerians. 89k+ are active (monthly). 57% ish retention. Monthly active = transact at least 10x a month. We have users who transact 10x a day. Uber eaters, bolt(ers), Digital marketers, etc

@JasonNjoku - we have 150k+ registered Nigerians. 89k+ are active (monthly). 57% ish retention. Monthly active = transact at least 10x a month. We have users who transact 10x a day. Uber eaters, bolt(ers), Digital marketers, etc But how many MAUs though🥱. I was at a 🇳🇬fintech startup a few weeks ago & I posed the question how many of them used any of the neo challenger banks as their main accounts. <20% - to my mind thats the real measure of fintech insurgency. Unless someone has done this already? https://t.co/v1Go7DBcHs

But how many MAUs though🥱. I was at a 🇳🇬fintech startup a few weeks ago & I posed the question how many of them used any of the neo challenger banks as their main accounts. <20% - to my mind thats the real measure of fintech insurgency. Unless someone has done this already? https://t.co/v1Go7DBcHs JasonNjoku @JasonNjoku

JasonNjoku @JasonNjokuPayday launched Payday 3.0 and appears to be enjoying notable traction. (See tweet above — and thanks for the transparency Favour 🙏🏽)

Rightfulshare, a South African income equality initiative, launched a universal basic income (UBI) pilot program in South Africa with UBI protocol GoodDollar.

PARTNERSHIPS

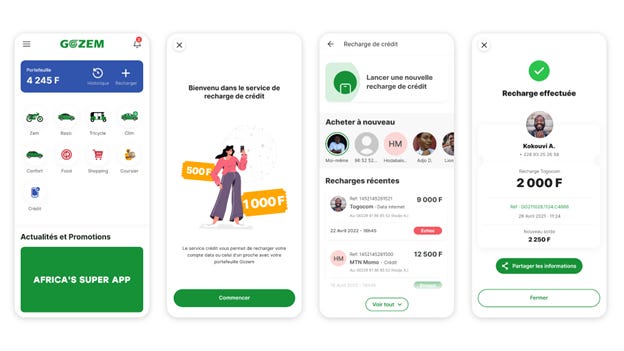

Francophone Africa-focused super app Gozem and global B2B digital micropayments platform DT One announced a partnership that allows Gozem’s users to purchase airtime recharges from the in-app Gozem wallet.

Nigerian financial institution Access Bank announced a partnership with Nigerian rewards platform Connected Analytics (ThankUCash) that gives 2.5% cash back rewards to Nigerian cardholders that use Access Bank POS terminals. [Writer’s note: I’m a Nigerian cardholder, and while I’ve never had a particular preference, I may just start looking out for Access Bank POS terminals.]

Ezra, an Emirati/Kenyan embedding lending & digital credit solutions provider, announced a partnership with Access Bank Botswana and Orange Money Botswana that gives Orange Money customers in the country access to microloans. The service, called N'stakolle loan, is the first ever digital loan product in the market.