150 African fintechs raised ~$1.55B in risk capital in 2023

Insights from the updated Afridigest Fintech Transactions Database

Happy New Year again, friends! The 2023 update of the Fintech Transactions Database is finally here.

In it, you’ll find all the announced fintech deals we tracked in 2023 from Week 1 to Week 52, plus all of the fintech deals from 2022.

That includes equity fundraises, debt fundraises, and M&A deals — and, in line with deal reporting best practices globally, it excludes grants.

Be sure to scroll to the bottom of this email — you’ll be able to download the database directly here. 🙏🏽

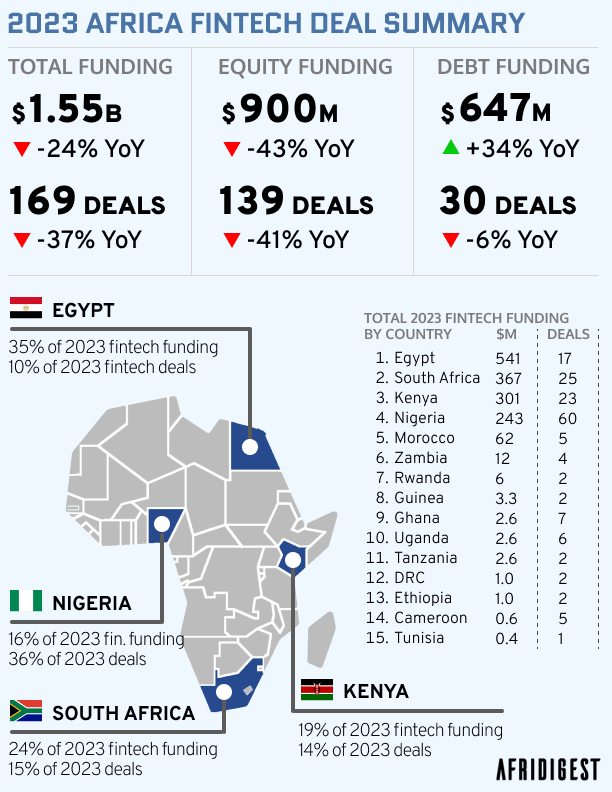

In 2023, 149 fintech startups in Africa announced raising ~$1.55B in risk capital across 169 transactions.

That’s an average of 14 deals and ~$129M in funding raised per month.

And while the total amount raised was down 24% from 2022, there’s a bit more nuance to the story. Things diverge quite a bit when looking at equity vs. debt.

Equity funding raised by African fintechs in the first half of the year fell ~43% from last year. But debt funding was up over 34%.

Notably, however, the rise in debt is due largely to three deals: MNT-Halan’s $140M and $130M securitized bond issuances and the $202M in debt financing raised by M-Kopa.

Here’s a quick summary of 2023 fintech funding across Africa:

In terms of verticals, Banking/Lending led the way, accounting for $0.63 of every dollar of equity raised and $0.97 of every dollar of debt raised in 2023.

Major players in the Banking/Lending vertical include digital banks like TymeBank, FairMoney, and Jamboo; lending platforms like MNT-Halan, Lulalend, and Lupiya; and asset financing platforms like M-Kopa, Moove, and Planet42.

Beyond equity and debt financing, fintech M&A levels across Africa were relatively stable y/y with 27 deals announced in 2023, compared to 26 in the same period last year.

Here’s a quick look at select acquisitions:

That’s a sampling of what’s in the database.

If you're interested in:

Detailed sub-vertical-level information about fintech fundraises in Africa

Analyzing the continent’s fintech M&A landscape

Seeing the investors leading & investing in fintech rounds in Africa at a glance

Identifying who’s lending to African fintechs

Understanding African fintechs by country, funding stage

and much more, then this database is for you.

It’s the most comprehensive dataset available on disclosed fintech transactions in Africa. And we’ll be improving it going forward.