Deal of the Week: Flutterwave acquires Mono in Africa's first YC-to-YC exit

2026 kicks off with a bang as Flutterwave, Africa’s largest payments technology company, announces its acquisition of Mono, Nigeria’s leading open banking infrastructure provider.

Deal Structure

Acquirer: Flutterwave (payments processor operating across 30+ African countries)

Target: Mono (open banking API platform)

Deal value: reportedly $25-40M (said to be $30M by insiders)

Deal consideration: all-stock transaction

Transaction advisors:

For Mono: External General Counsel’s Rachna Shah, Goodwin Procter LLP

For Flutterwave: Chrysalis Capital’s Nichole Yembra

Status: Pending regulatory approvals

Post-deal: Mono will continue operating as an independent entity with no changes to leadership, team, or day-to-day operations

Key Personalities

Abdulhamid Hassan, Co-Founder & CEO, Mono

Launched first startup (Washify - ‘Uber for laundromats’) at age 17

Sold another startup, Skylar Labs/Hyphen, for an undisclosed amount

Launched mobile app for offline payments OyaPay

Worked at Paystack as a software engineer

Met Mono co-founder in a programming group on Facebook

Prakhar Singh, Co-Founder & CTO, Mono

Technical architect behind Mono’s infrastructure

Based remotely in India

Olugbenga ‘GB’ Agboola, Founder & CEO, Flutterwave

Since its 2016 launch, Flutterwave has processed over 1B transactions worth over $40B; in 2022 it announced a $3B valuation and proclaimed itself ‘Africa’s most valuable startup’

About Mono

Founded in 2020, Mono has built Africa’s most widely-adopted open banking infrastructure. The company’s API platform enables businesses to securely access bank data, initiate payments, and verify customer identities.

Mono addresses a critical infrastructure gap across African markets where credit bureaus remain limited and financial data remains fragmented. Nearly all Nigerian digital lenders now rely on Mono’s infrastructure.

Founder-problem fit: While at Paystack, Hassan experienced firsthand how limited access to financial data hindered lending and risk assessment. He left the company after its acquisition by Stripe to pursue a specific thesis: that financial data infrastructure, not just payment processing, would power Africa’s next fintech wave. Mono was born from that conviction.

Total capital raised: ~$17.5M

Fundraising timeline & announcements:

Sep 2020: $500K Pre-seed

May 2021: $2M Seed

October 2021: $15M Series A

Investors:

Tiger Global (Series A lead)

Target Global

General Catalyst

SBI Investment

Entrée Capital (Seed round lead)

TCVP

Lateral Frontiers

Ventures Platform

Golden Palm Investments

Ingressive Capital

Rally Cap Ventures

Acuity VC

Y Combinator

Key metrics:

8M+ bank account linkages (said to be roughly 12% of Nigeria’s banked population)

100B+ financial data points delivered to lending companies

Millions in direct bank payments processed

Major customers include Visa-backed Moniepoint and GIC-backed PalmPay

Previous valuation: $50M post-money at 2021 Series A, per Pitchbook — but TechCrunch contemporaneously reported the company’s valuation as “north of $100M.”

Strategic Rationale

For Flutterwave, the acquisition enhances its offering and gives it the ability to facilitate authenticated, account-to-account flows and instant identity verification. The company can now offer end-to-end infrastructure within a single stack:

Payments processing (existing capability)

KYC and identity verification (via Mono)

Bank account verification (via Mono)

Data-driven risk assessment (via Mono)

Account-to-account payments (via Mono)

One-time and recurring direct bank payments (via Mono)

For Mono, joining Flutterwave provides immediate scale and distribution, plus the ability to wait for the open banking landscape to ripen. Flutterwave’s existing presence across 30+ African markets, local licenses, enterprise customer relationships, and compliance infrastructure positions Mono to expand rapidly once regulatory frameworks mature.

The deal also creates a unified environment where payments and financial data coexist, reducing complexity for developers and accelerating time-to-market for new products.

The Competitive Landscape

When Mono launched in 2020, Nigeria’s open banking space included several well-funded competitors:

Okra (Base10 Partners-backed, raised $16.5M) — shut down May 2025 after regulatory delays and currency challenges

Stitch (Ribbit Capital-backed) — pivoted toward deeper payments ecosystem, raised significantly more capital

Mono’s acquisition for roughly $30M — after raising at a $50M valuation — is the latest shoe to drop for the continent’s open banking pioneers.

Open banking may be the future, but first movers have faced real challenges.

In Their Own Words

Hassan (Mono CEO): “An acquisition was not on our radar. Mono’s growth curve, product, and team are stronger than ever, and the future of open banking has never been more exciting…

We chose to join forces with Flutterwave because of the opportunity to create something phenomenal together: a more complete financial operating system for African businesses. Together, we can go deeper, move faster, and serve developers and businesses at scale.”

Agboola (Flutterwave CEO): “This acquisition is about building the connective tissue for Africa’s next phase of fintech growth. Payments, data, and trust cannot exist in silos. Open banking provides the foundation, and Mono has built critical infrastructure in this space…

By bringing Mono’s world-class open banking and accounts-based payment infrastructure into the Flutterwave ecosystem, we are doing more than just adding a tool; we are upgrading the engine.”

Why The Deal Matters

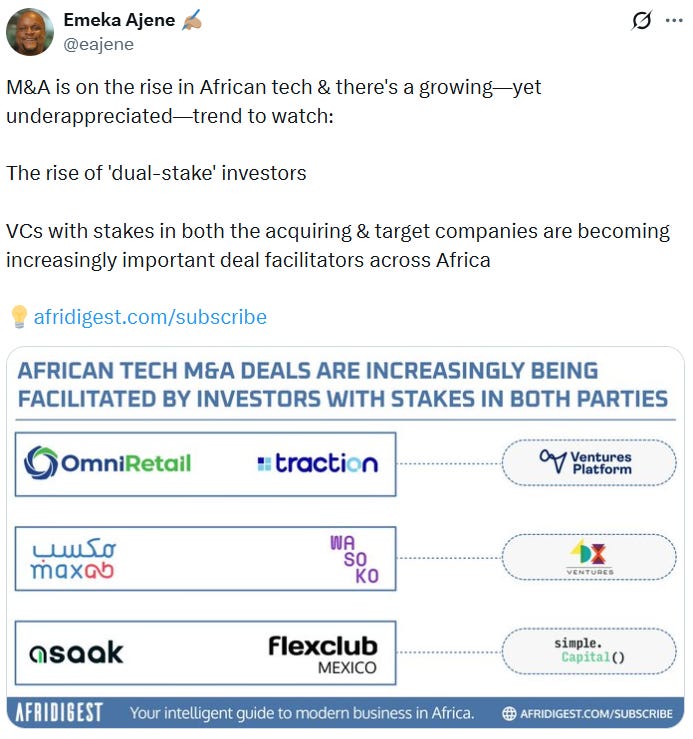

Major consolidation signal. This transaction could indicate that African fintech is entering a renewed consolidation phase as the obstacles to achieving venture scale outcomes in certain verticals become more apparent.

Account-to-account payments in Africa. Flutterwave is betting the next phase of growth in African payments comes from bank rails, not cards. Flutterwave already powers card, mobile money, and cross-border payments; Mono adds the direct bank payment layer that bypasses traditional card infrastructure entirely.

The rise of pragmatism. Mono chose strategic consolidation with an industry leader rather than pursuing standalone success which would require additional capital and introduce commensurate growth pressures in an uncertain market.

Deal Note

Illiquid-to-illiquid swap, not cash exit: Despite media reports of ‘liquidity for investors,’ the all-stock transaction means Mono investors swapped positions in a Series A fintech for equity in a larger, more mature (but still private) platform.

Paper gains: Some early Mono investors are said to have seen 20x returns with the deal, but these are unrealized gains tied to Flutterwave’s current valuation. With Flutterwave’s CEO stating ‘we're not in the IPO race’ last month, the path to actual liquidity isn’t yet clear.

Relative sizes: Assuming valuations of $3 billion and $30 million for Flutterwave and Mono respectively, the acquisition cost Flutterwave 1% in equity.

Trivia

This marks the first time two Y Combinator-backed companies have completed an acquisition in Africa.

Both companies count Tiger Global among their investors, but the deal grew from a multi-year product partnership starting in 2021, not investor matchmaking.

Additional Resources

Bottom line: This deal offers a reminder that timing is everything. While open banking remains promising as a vertical, Africa’s first wave of open banking upstarts have faced real challenges as they’ve had to innovate ahead of regulations and widespread adoption.

The acquisition positions the combined Flutterwave-Mono entity as the dominant open banking infrastructure player across anglophone West Africa, with the time and resources to see the open banking landscape and regulatory environment develop.

The deal also signals the ongoing maturation of fintech infrastructure in Africa as best-in-class providers consolidate into comprehensive platforms.

📊 Need a trusted partner for a custom project? Join leading founders, executives, and investors who rely on Afridigest Intelligence for strategic advisory, analysis, and visibility ➜ afridigest.com/intelligence