Earned wage access, explained: The on demand economy meets fintech & HR tech

A new frontier of fintech marries the on-demand economy with fintech and payroll tech across Africa and other markets.

Afridigest provides ideas & analysis for startup founders, operators, and investors across Africa and beyond. This essay is a primer on earned wage access, an under-the-radar fintech frontier, with an accent on Africa.

It’s been a while since a Saturday essay so if you like this post, tap the heart icon, share it, or let me know by leaving a comment or sending a Twitter message: @eajene.

If you’re new, subscribe to get posts like this delivered straight to your inbox.

In the not-so-distant future, ‘streaming salary’ might become the norm; wages might be wired continuously, in real time, to workers' wallets worldwide as they're earned.

But that future doesn't yet exist.

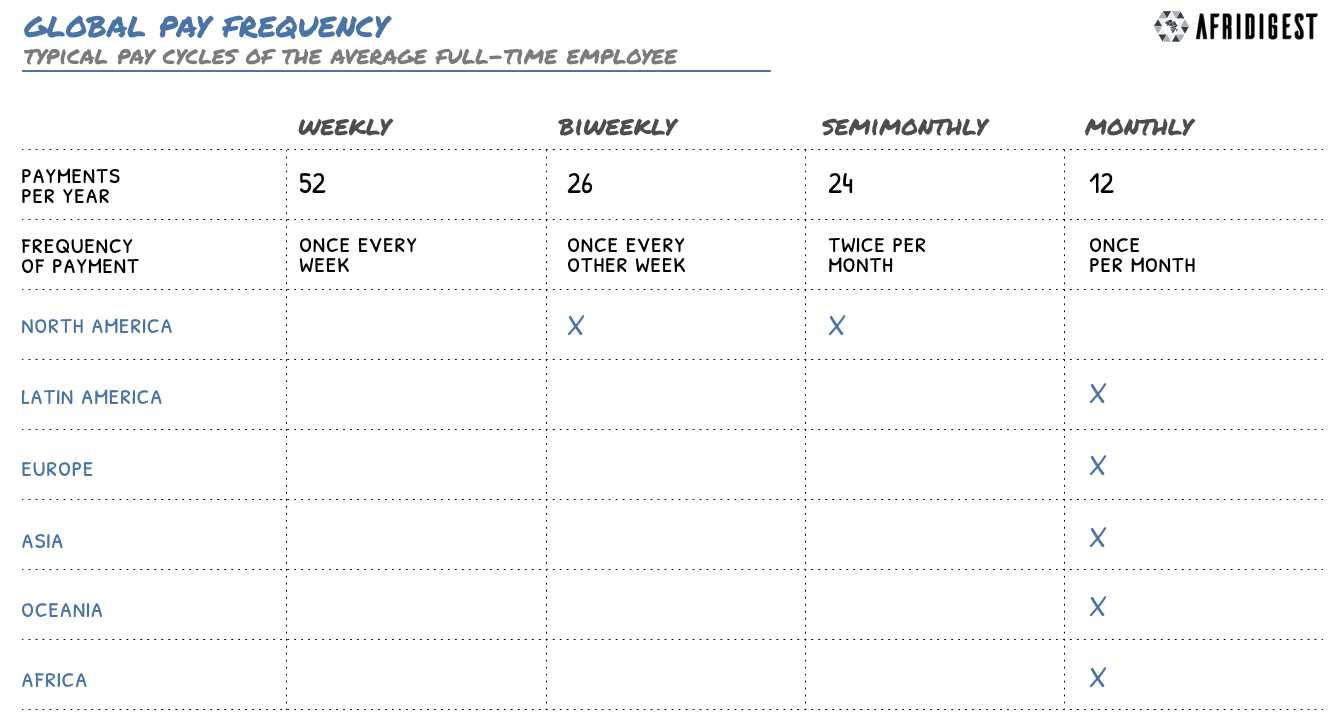

Today, employees are generally compensated on fixed payroll cycles. In North America, for example, salary is typically paid bi-weekly or semi-monthly for the average employee. And across the rest of the world, one paycheck per month is largely the norm.

But while salary is paid on a fixed cycle in arrears, consumption & commerce happen daily. And because many workers lack significant savings, the time between pay cycles is often marked by cash flow challenges, a lack of liquidity, and financial stress.

That's one reason the global payday lending market is large and growing. Workers who need help between paychecks turn to payday loans and similar solutions, but these usually come at a steep cost — excessive interest rates, high fees, and a strong potential of entering into debt traps.

Enter earned wage access.

“Amazon Prime, Lyft, Netflix, Venmo: the world has changed dramatically to usher in a generation of on-demand services, yet most organizations still think about payday as a rigid, set-in-stone process.” — Joyce Maroney, Executive Director, The Workforce Institute at Kronos

Over the last decade, a slew of startups has begun seizing the opportunity to redistribute value from payday lending incumbents back to employees. Often called ‘on-demand pay,’ ‘salary-on-demand,’ or ‘earned wage access’ (EWA), this growing category of alternative finance helps address liquidity gaps employees face between paychecks.

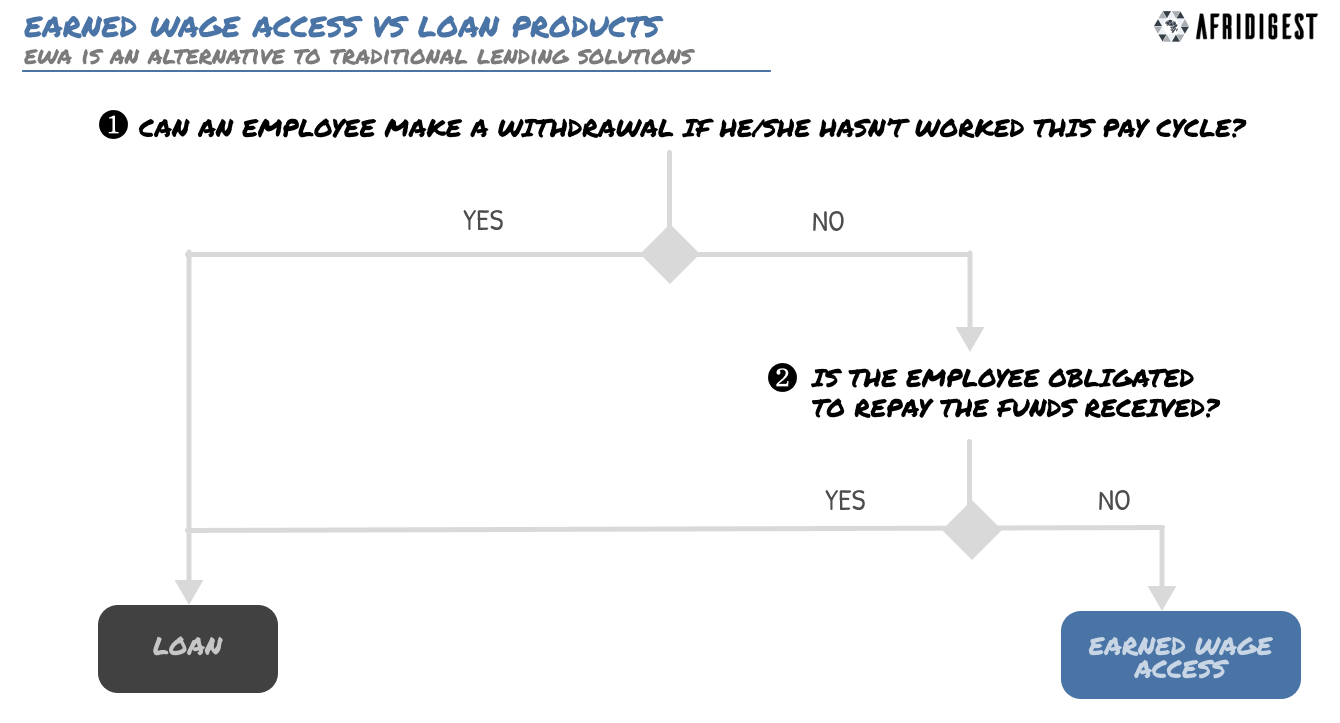

While EWA providers employ a variety of commercial models, EWA products generally work in a similar way: the EWA provider integrates with data sources (e.g., the employer’s payroll system) to calculate accrued wages and make an appropriate amount available, the employee requests withdrawals from the EWA provider when needed, approved funds are disbursed in near real time before payday, and the employee receives the balance of his/her regular salary minus the amount withdrawn and any applicable fees on the regular pay cycle.

Unlike payday lending and similar solutions, there are no payback obligations with EWA. EWA platforms simply give employees access to their earned and accrued, but unpaid wages. Consequently, because EWA is not a loan, there’s no payback, no interest, no late fees, and no risk of entering debt traps; in fact, EWA reduces employee reliance on predatory debt.

While direct-to-consumer EWA models are increasingly common in some markets, EWA platforms typically employ a B2B2C model where they partner with employers to reach employees. Critically for employer adoption, payroll remains on the regular cash flow cycle; employers can enable EWA with no disruption to working capital and only minor changes to payroll administration. And in most cases, they can also set additional guidelines and restrictions, such as which employees can access EWA, how much they can access, and how frequently.

While it’s clear that EWA addresses a real pain point for employees worldwide, employers now increasingly recognize EWA’s positive impact on business results. On the one hand, it’s a differentiated benefit that bolsters employee recruiting and retention, and on the other, it’s a financial wellness tool that amplifies employee productivity & engagement by reducing financial stress.

EWA platforms generally position themselves in the marketplace as a socially responsible, financial wellness alternative to payday lenders. As they generally seek to take market share away from incumbent payday lending providers, many use the global payday loan market as a proxy for the scale of the EWA opportunity — it’s estimated at over $30 billion today and is projected to reach ~$50 billion by 2030.

Earned wage access is on the rise across developed & emerging markets.

“[Earned wage access] represents a pertinent and powerful solution for a universal problem. [It] liberates workers from onerous pay-day loans and informal lending while still providing them affordable means to meet their immediate needs and wants. For employers, [it] not only is a way to provide for the financial well-being of their employees, but also makes good business sense of higher retention and loyalty.” — Sandeep Patil, Partner, QED Investors

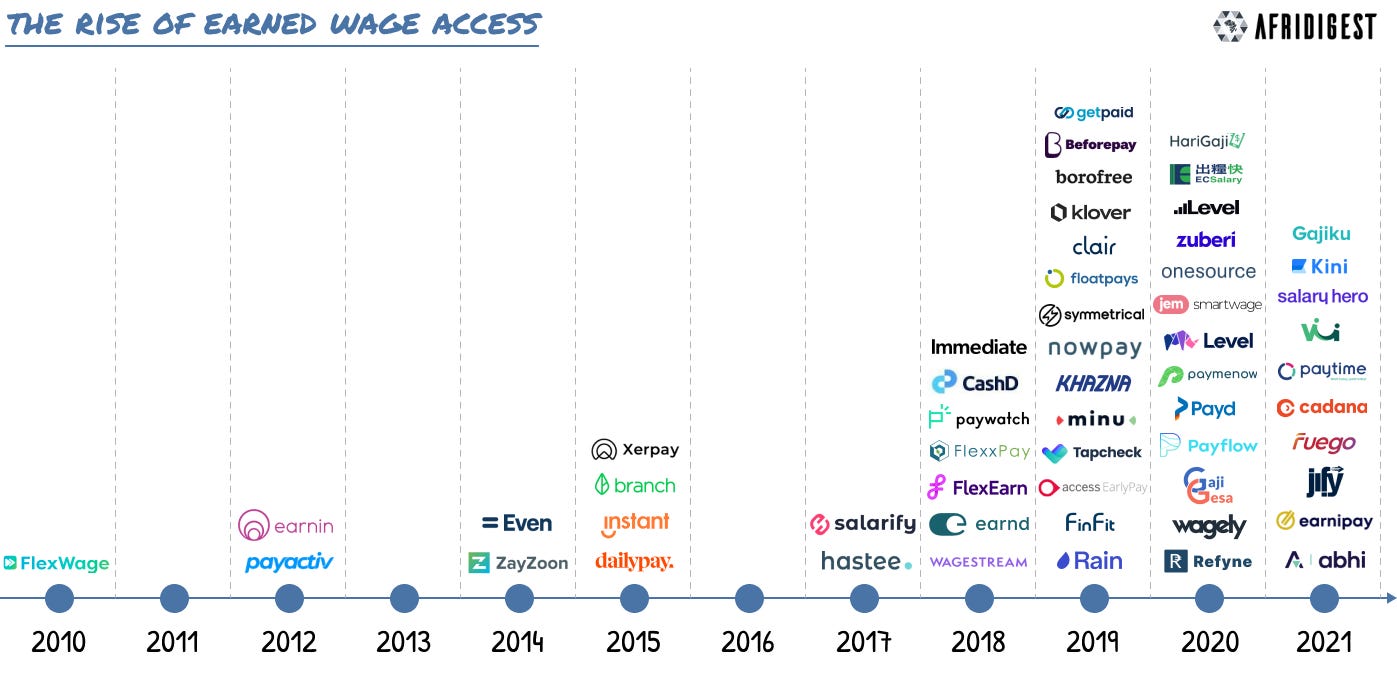

Earned wage access first arose in the 2010s in the US with platforms like Flexwage, PayActiv, and Earnin pioneering the concept. And today, even juggernauts like Block (formerly Square) offer EWA solutions. While the US still leads the way according to the Everest Group & other research firms, earned wage access solutions are increasingly a worldwide phenomenon, particularly since 2018.

Notably, startups offering earned wage access products raised more in debt and equity in 2021 than they did cumulatively from 2015 to 2020 — a sure sign of EWA’s global momentum.

While all workers can benefit from EWA solutions, EWA is arguably more valuable where workers have lower levels of savings and thus largely rely on earnings to meet expenses.

In developed markets, this typically means a primary or initial target market of blue-collar workers and entry-level or lower-skilled employees. But across emerging markets where large segments of the population remain financially underserved, EWA is applicable and appealing to a much broader set of the population from day one.

It’s perhaps not surprising then that EWA platforms, while still new locally, are seeing tremendous momentum across emerging markets today.

🥰 Like Afridigest? You can now support us with a paid subscription:

Earned wage access may be a natural fit for African markets.

“We’ve seen earned wage access grow rapidly in many markets and believe it’s a natural fit in Africa.” — Brendan Dickinson, General Partner, Canaan.

Across Africa, access to formal credit is limited — it’s one reason why the continent has some of the highest levels of borrowing from family or friends according to the World Bank. Moreover, levels of insurance penetration across Africa are half the world average according to McKinsey; notably, per Speedinvest, insurance penetration has a negative correlation with EWA usage. These and other tailwinds such as low private savings rates bode well for EWA across Africa.

So, a number of enterprising players are seizing the opportunity to pioneer EWA across Africa’s most promising hubs.

EWA’s outlook across Africa.

Still, several questions surround pure-play EWA platforms across Africa (and the world).

Is it a standalone business or an add-on product? Is it inherently a commodity or is there possible differentiation? Are EWA products natural partners or eventual competitors to HR SaaS offerings? How do you win?

While the majority of these questions are beyond the scope of this particular article, what’s clear is that, 1) EWA platforms offer a great way to access unique employee data, and 2) generally speaking, EWA tech on its own is easily replicable.

The main ‘technical’ challenge lies in integrating with a wide variety of payroll systems — a challenge that is likely to be easily overcome. Beyond that, access to a significant lending capacity/balance sheet can help gain initial momentum, but ultimately winning in the near term is likely to be a function of a differentiated distribution/GTM strategy that withstands longer sales cycles.

That said, the pure-play EWA platforms of today will likely follow one of two paths over the medium/long term: becoming a full-service benefits & employee wellness platform (i.e. offering some mix of savings, insurance, investments, personal finance education & management, and benefits management SaaS) or becoming a full-service credit provider/neobank to both employees and employers.

So, across the continent, the transition of Egypt’s Khazna from an EWA provider to a financial super app, the rebranding & refocusing of South African EWA platform Smartwage to the HR platform Jem, and the launch of earned wage access offerings by Nigerian payroll platform SeamesssHR are likely to be particularly instructive to current and future market participants.

The above article is an introductory primer on earned wage access with a minor focus on platforms across emerging market & Africa. If you’re interested in future offerings that go deeper, click here & we’ll follow up.

ADDITIONAL READING

On-demand pay: Payroll that works for all. (PDF.) September 2020. EY

Apps will get you paid early, for a price. Oct. 2020. NYTimes.

Understanding earned wage access and payroll. (PDF.) American Payroll Association. April 2021.

'Earned wage' startups winning over VCs with an ESG agenda. Sep. 2021. Pitcbook.

Fintech to the (worker) rescue: Earned wage access and employee retention. (PDF.) Harvard Business School. March 2022.

Global earned wage access (EWA). (PDF.) October 2022. Everest Group.

Empowering financial inclusion through payments. (PDF.) Nov. 2022. JP Morgan.

Thank you Emeka for the insight. The misalignment of access to pay with timing of pay is our core focus @paymasta. We are looking deep into finance education, proper management where we create and offer more value to the African workforce.

Awesome piece, Emeka!

For this model, it's very reliant on employers unlike payday loans which depends on employees. I worry that there won't be enough big companies to make this a standalone business and the smaller ones have working capital reliant on receivables and thus don't have regular paycheck cycles.

Basically do they go full HR or go full Banking?

Integrating to HR systems seem easy but I think this is a solution that wins on distribution vs product. More partnerships with HR SaaS will help. I also think there can be some data play. With access to users payroll, you can advice on other aspects of an employee's spending.

What about "ethical" BNPL? Can something like Pipe work here? - pay for future salary and earn some interest on it. This may cannibalise their main business, but I guess you need this sort of mad thinking to exploit opportunity.

Pardon my rant😅.