Business blueprints: How companies in Africa are transforming cost centers into cash

Africa-focused innovators can learn from the examples of these companies that are transforming cost centers into new revenue streams.

Afridigest is your intelligent guide to Africa’s tech ecosystem. We provide ideas, analysis, & insights for Africa-focused founders, executives, and investors.

This Saturday essay highlights companies in & outside of Africa that are transforming cost centers & internal infrastructure investments into new revenue streams. (It also contains short audio/video clips of Jeff Bezos, Ham Serunjogi, and Tayo Oviosu — hear them explain in their own voices.)

If you’re new here: welcome — an original essay like this goes out on Saturdays (occasionally), the Week in Review is sent on Mondays, the Fintech Review goes out on Sundays, and founder interviews or other content goes on Wednesdays.

One way to think of a company is as a machine that turns investments — labor, time, money, raw materials, equipment, etc. — into profit.

So if you were to open a lemonade stand, you’d invest in the stand, invest in the lemons, invest in the sugar, and turn that into profit by selling cups of lemonade at a high enough margin.

But what if instead of just selling lemonade, you could also sell lemonade-making-as-a-service?

You’ve already built the lemonade production infrastructure, and now you'd not only earn money from customers who buy your lemonade, you’d also earn money from lemonade makers that use your new LMaaS offering. That’s smart business.

That’s a simplified example of course, but that playbook — turning costs centers and infrastructure investments into new revenue streams — is used by some of the savviest companies around the world.

A recent example is Intel.

In his first public announcement since becoming CEO in 2021, Intel’s chief executive Pat Gelsinger announced a strategy shift.

The company, which has built significant manufacturing expertise and infrastructure over its 50+ years of operations, will no longer just make its own lemonade semiconductors, it will also provide lemonade-making-as-a-service make chips (and more) for other companies under a new ‘open systems foundry’ model.

In other words, Intel is transforming one of its main cost centers — chip manufacturing — into a new revenue stream.

And while the Intel Foundry Services business unit contributes just 1% of Intel’s revenue today, the company sees this model as key to its future. Gelsinger said in 2021, “We conservatively size the foundry opportunity as a $100 billion addressable market by 2025.”

While the impact of Intel’s transformation remains to be seen, one company has famously reaped massive benefits from running this costs-to-revenues playbook: Amazon.

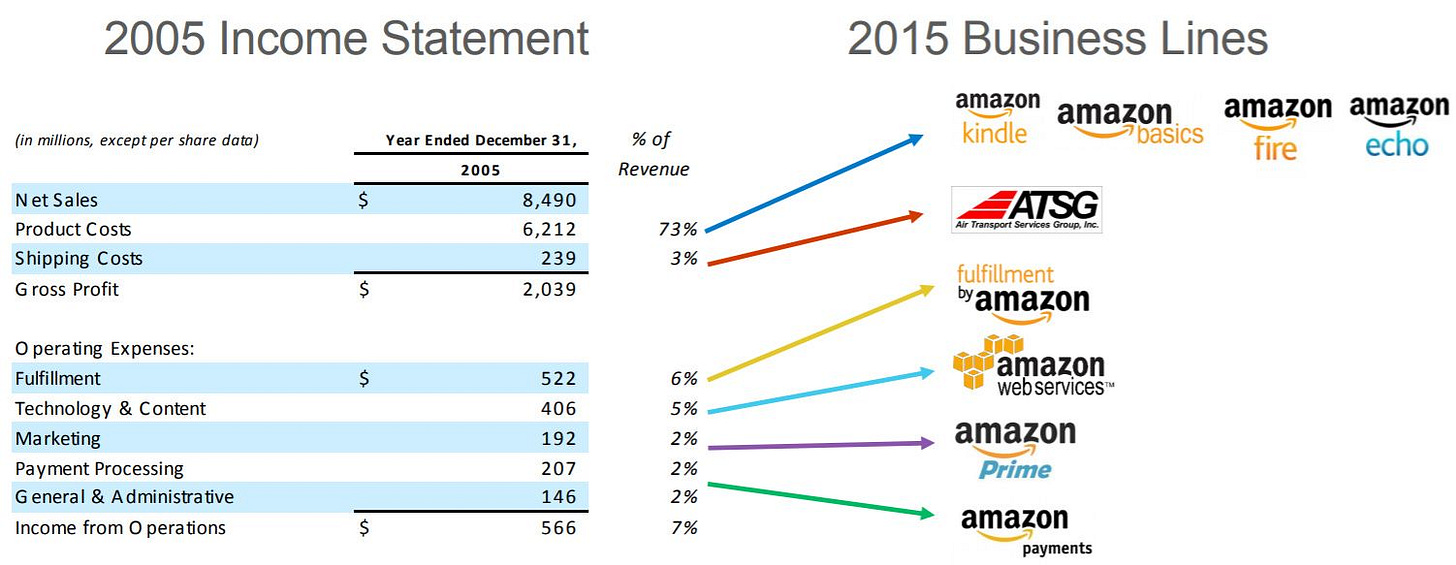

The company has systematically transformed all of its main cost centers into long-term sources of revenue in one form or another.

Perhaps most famously, it transformed its tech infrastructure — a significant cost center for large e-commerce players — into Amazon Web Services (AWS), the B2B cloud computing platform with over 1 million active users that now generates over $80 billion in revenue annually and accounts for ~75% of the company’s operating profit.

But that wasn’t always the plan.