Afridigest is your intelligent guide to Africa’s tech ecosystem. And the Afridigest Fintech Review is a week-to-week recap of what happened in African fintech.

Hello again, friends! Remember: this Fintech Review goes out on Sundays and the regular Week in Review goes out on Mondays. (If you’re here because of the upcoming piece on telco-led super apps, I’m late, but it’ll be published shortly.)

If you find our work valuable, help us add more value to you & others by upgrading your subscription.

On to the week’s highlights:

• It was the third week of 2023 (after Week 1 and Week 10) with no publicly announced fintech fundraises in Africa.

• News of the week: Instead of fundraises we got pivots and shutdowns. [Pivots are/can be good though.]

• Behind the paywall today: A great read on today’s fintech landscape. Some insights on how African banks and insurance companies are thinking about potential fintech partnerships. And some successful fintech pitch decks to study.

• Companies appearing in today’s Fintech Review: OurPass, LazerPay, Lidya, dLocal, Instance, ETAP, Fonbnk, GoFree, Tanda, Pesawise, Yellow Card, OnePipe, Bitnob, & more.

• Executives appearing: Chipper Cash’s EBANX’s Wiza Jalakasi, MIP Holdings' Richard Firth, Lidya’s Tunde Kehinde, Visa’s Eva Ngigi-Sarwari, Finbots.ai’s Samson Mutisya, Oye’s Kevin Mutiso, Nala’s Benjamin Fernandes, Curacel’s Henry Mascot, & more.

➜ If you’re a free subscriber, you’ll only see a preview below. Upgrade for full access.

⭐ Not interested in fintech? No problem: visit the Notifications section of your Account Settings page and deselect the Fintech option.

A MESSAGE FROM AFRICREATEBe smart. A trusted thinking partner can help you & your team.

Africreate is a trusted research & advisory firm to leading corporates, startups, and investment firms operating in African markets. We offer customized intelligence-led solutions including:

Custom Research, Analysis, & Advisory for Bespoke Projects

Training, Executive Education, & Corporate Innovation Solutions

Strategic Communication & Thought Leadership Services

Week 15 2023: April 9-15

💸 FundraisesLooks like another week with no fintech fundraises announced.

📰 News of the WeekBut you know what was announced? Pivots and shutdowns.

OurPass, the Nigerian one-click checkout platform that described itself as ‘Fast for Africa,’ announced its pivot into a ‘neobank for businesses of all sizes.’ (Nearly a year to the day after the original Fast shut down by the way.)

And Lidya, the digital B2B lending platform with a significant European focus, announced its pivot or ‘shift in focus’ from lending to credit infrastructure — “provid[ing] financial institutions with the [tech] infrastructure to acquire customers and originate, manage, and collect loans” in order to unlock credit for Africans.

I’m actually a big fan of pivots.

And Tunde Kehinde, Lidya’s CEO, sees this “as a natural evolution of [Lidya’s] mission.” I can’t say I’ve done the work to have an opinion here yet, so I’ll stick to the facts. But I certainly have questions. And this might be the wrong take, but welcome back, Lidya :)

Aside from that, Nigerian crypto payment gateway Lazerpay announced that it’s ceasing operations due to its inability “to close a successful fundraising round.”

If you know Njoku Emmanuel, let him know Afridigest would love to discuss his story. But until then, here’s a reaction from Muyiwa at Techpoint that resonated:

🚀 Partnerships & Product LaunchesLAUNCHES

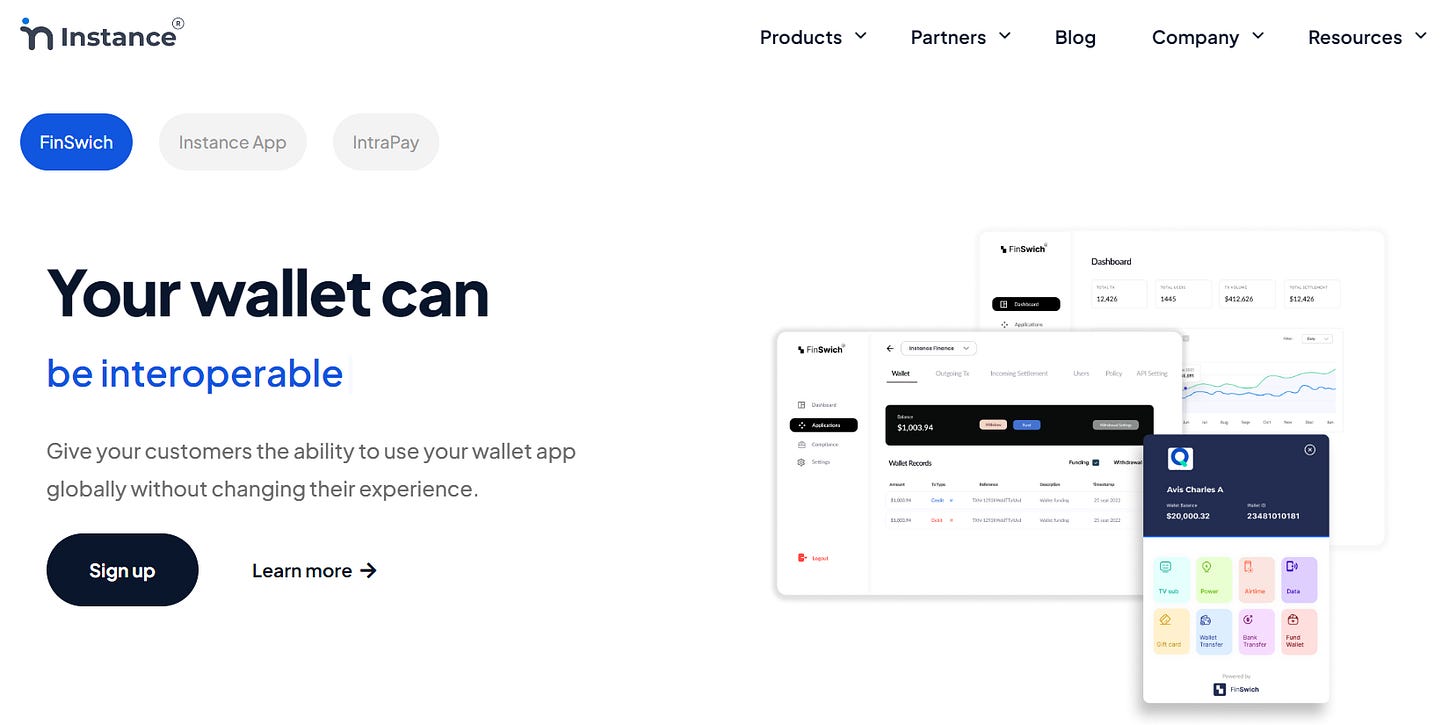

Nigerian payments infrastructure provider Instance formally launched this week. It announced its multi-currency personal finance app Instance App and its wallet-to-wallet payment interoperability platform Finswich. The company also disclosed that it raised a pre-seed round from Canada’s Pacer Ventures in June 2022.