Afridigest Fintech Review: Gutsy Guinean fintech gets greenbacks to grow

Week 9 2023: February 26 - March 4

The Afridigest Fintech Review is a weekly recap of what happened in African fintech.

Hello again, friends! Remember: this paywalled Fintech Review goes out on Sundays and the regular Week in Review goes out on Mondays. And in case you missed it, we published 'Clever credit: How African startups are using data & distribution to de-risk lending' yesterday.

Today’s Fintech Review is a banger. 🧨 If you’re not yet a paying subscriber, you’re missing out.

But on to the week’s highlights:

• Two fintech deals were announced totaling ~$3.3M in disclosed equity raised. (One in Guinea!)

• Fintech news worth noting: Hackers seem to have stolen over $6M from 'Flutterwave accounts,' but it’s not clear if it’s from the company itself or from a Flutterwave user/merchant; Payday (who you might remember from Week 7’s 'Every day is PayDay') is reportedly raising a $1.5M seed round; telco mobile money service Orange Money has a new Head of Africa & the Middle East; and one of Africa’s notable fintechs was awarded a US patent, but it has some interesting rumors swirling around it.

• Companies appearing in today’s Fintech Review: YMO, InfiniteUp, Stitch, Ozow, Peach Payments, MFS Africa, Truzo, MoneyHash, Fawry, ImaliPay, FlexID, Payscribe, Nala, Brass, Fido, & more.

• Executives appearing: Ria Money’s Shawn Fielder, MTN’s Dioum Serigne, Orange’s Aminata Kane Ndiaye, Bank Zero’s Michael Jordaan, YMO’s Barry Abdoulaye, Fonbnk’s Michael Kimani, Direct Transact’s Christo Davel, aYo Holdings’ Heidi Badenhorst, Recursive Capital’s Abubakar Nur Khalil, Chipper Cash’s Ham Serunjogi, MUDA’s Suleiman Murunga, Revio’s Nicole Dunn, Bamboo’s Richmond Bassey, PaySky’s Waleed Sadek, NowNow’s Sahir Berry, & more.

➜ If you’re a free subscriber, you’ll only see a preview of this Fintech Review. Remember to upgrade your subscription or start a trial to read it in full.

⭐ Not interested in fintech? No problem: visit the Notifications section of your Account Settings page and deselect the Fintech option.

Week 9 2023: February 26 - March 4

💸 FundraisesFINTECH & FINTECH-ADJACENT FUNDRAISES

🇬🇳 YMO (formerly YMoney), a Franco-Guinean digital payments platform, raised a ~$3.2M (€3M) seed round. Created in 2019, YMO has over 500,000 customers in France & Guinea today and plans to expand to a number of new countries, including Senegal, Ivory Coast, Congo, Belgium, Italy, Spain, and the United States, in the near future.

🇳🇬 InfiniteUp, makers of a Nigerian personal financial app, raised $150K.

💡 Executive Insights: Buy vs. BuildFormerly CEO of one of South Africa’s largest banks, Michael Jordaan’s new digital bank, Bank Zero, was built from the ground up. Here’s why:

Pair with: Michael Jordaan on how Bank Zero has transformed the South African banking industry (video)

🚀 Partnerships & Product LaunchesLAUNCHES

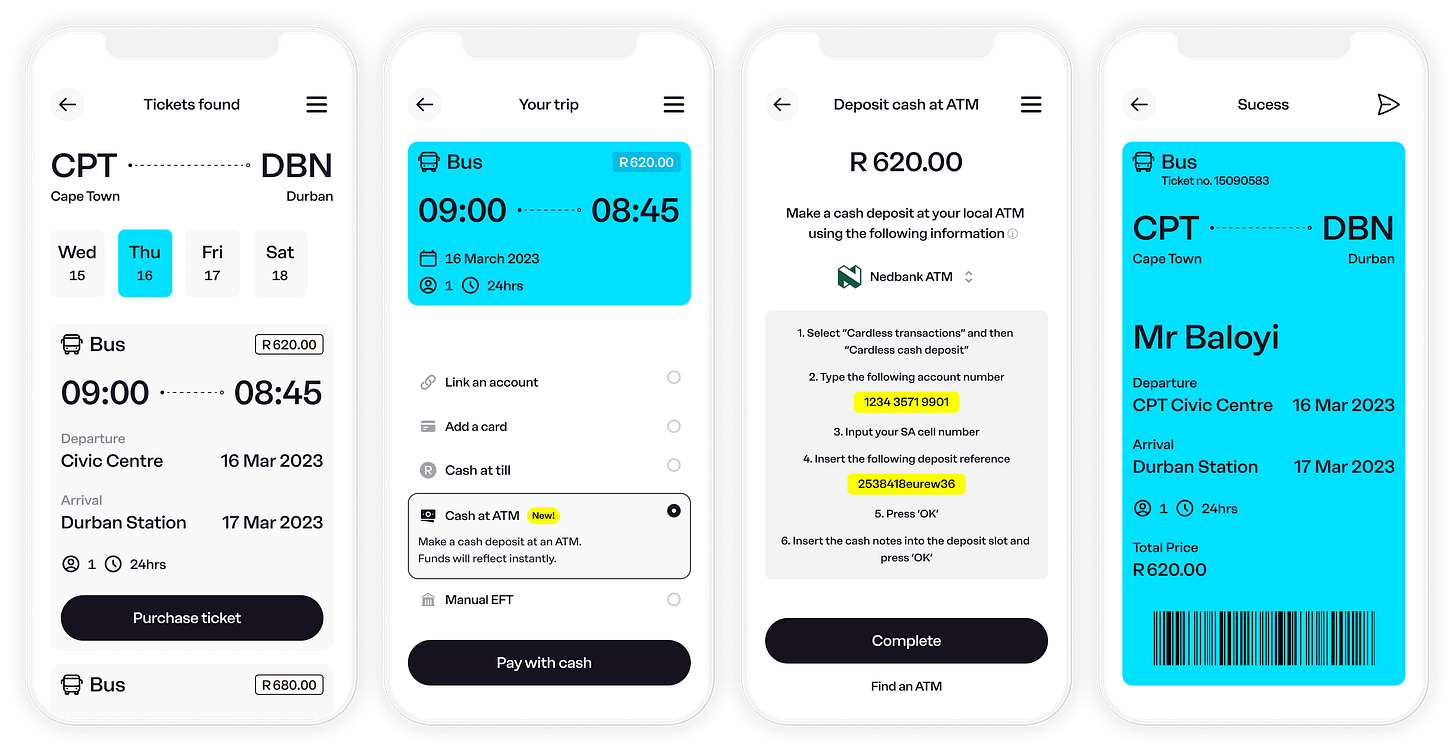

South African API payments infrastructure platform Stitch launched CashPay. The new payment method allows businesses in the country to accept cash payments made at cash-in points across the country with immediate recognition of payments in customers’ digital accounts.

The Central Bank of Nigeria launched USSD functionality & other enhanced services for its central bank digital currency, the eNaira. Users can now make eNaira transactions via the USSD code *997*50# and can also send eNaira directly from their wallets to an ATM and withdraw the cash equivalent. Moreover, the network of physical bank agents in the country will now perform eNaira transactions as well.

South Africa’s Capitec Bank recently launched API-based Capitec Pay as part of its push toward open banking. And this week:

South African payments gateway Peach Payments launched its Capitec Pay integration, allowing Peach Payments merchants to offer their customers the option of paying via Capitec Pay.

South African API payments infrastructure platform Stitch launched its Capitec Pay API integration, allowing Stitch clients to offer their customers the option of paying via Capitec Pay.