Morocco's momentum: Charting champions in the Cherifian kingdom

Afridigest is your intelligent guide to Africa’s tech ecosystem. We provide ideas, analysis, and insights for startup founders, executives, and investors across Africa and beyond.

This Saturday essay continues where Wednesday’s essay on Francophone Africa left off, with a particular focus on Morocco.

It contains:

• A showcase of the 20 Moroccan startups that announced raising venture capital in 2023

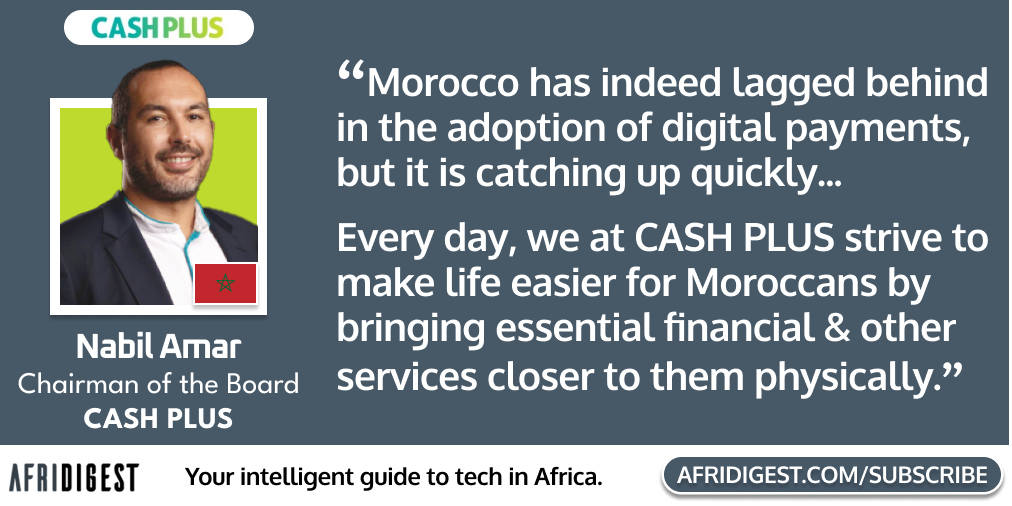

• An exclusive interview with Nabil Amar, Chairman of the board of Cash Plus, which accounted for 80% of the funding raised by Moroccan startups last year

• A listing of investors who backed Moroccan startups in 2023

• A look at the most active VC in the country last year

• Thoughts from a General Partner at a VC firm that typically focuses on Anglophone Africa on why they’re now actively investing in Morocco, plus some advice for founders in the country.

Happy reading! If you’re new here: welcome — the Week in Review is sent on Mondays, the Fintech Review goes out on Sundays, and other content goes out on Wednesdays and/or Saturdays. For past essays and digests, visit the archive & Afridigest.com.

➜ And if you’re not yet a premium subscriber, upgrade your subscription here.

Years ago, I visited Morocco for the first time to pitch Francophone Africa-focused super app Gozem at the Demo Africa event in Casablanca.

There, I met Chefaa’s Dr. Rasha Rady, Verto founders Ola Oyetayo and Anthony Oduwole, then Cloud9xp founder Tesh Mbaabu (he’d later sell the company to focus on Marketforce), and several other impressive innovators.

Stephen Ozoigbo and Harry Hare tirelessly helped all of us founders in attendance prepare our pitches. And if memory serves correctly, Tunisian assistive mobility platform Hawkar and Nigerian/British cross-border payments platform Verto were among the winners.

After the ceremony, I was briefly accosted by a group of young Moroccan students. They loved my pitch — thank you very much — and felt I was robbed by the judges.

Perhaps not surprisingly (and due also to experiences on subsequent visits), Morocco has since held a warm place in my heart.

I haven’t written much about Morocco or companies in the country in the past, but today’s post is dedicated to those students 🙂🇲🇦

One of the main stories of 2023 in African tech was the continued rise of Francophone Africa.

And leading the charge for the region was Morocco.

Outside of the four ‘NEKS’ markets (Nigeria, Egypt, Kenya, and South Africa) that perennially dominate Africa’s startup scene, the North African country was the top country — in the 50 that make up the rest of Africa — for both venture capital deals and total funding raised on the continent last year.

In total, twenty Moroccan startups announced raising over $75 million in VC funding in 2023 — with the fintech sector leading the way, followed by the logistics sector.

Here's a look at those twenty startups:

The vast majority (80%) of the funding raised by startups in Morocco last year went to CASH PLUS — thanks to a $60 million investment by the IFC, Mediterrania Capital, and FMO (the Dutch entrepreneurial development bank).

What’s Cash Plus? It’s a payments platform focused on Morocco’s bottom-of-the-pyramid customers.

The company provides the cash-in and cash-out components of various financial services in Morocco — predominantly those related to inbound remittances and in-country payments — via a network of agents and branches across the country.

Many of Morocco’s financially underserved citizens rely on Cash Plus to pay bills and withdraw funds transferred to them in cash.

And in the world’s most cash-reliant country, that’s big business.

The company generated an estimated ~$42 million (€39 million) in annual revenues in 2020, for example.

I interviewed Nabil Amar, now Chairman of CASH PLUS’s Board of Directors, about the company’s business, its operating environment, and more. Here are lightly edited highlights from our conversation.

Ajene: Morocco is a heavily cash-based economy, and at the same time, it's a center of banking power on the continent with Banque Populaire, Attijariwafa Bank, and Bank of Africa each generating over $1 billion in revenue annually. How do you see the market need and commercial opportunity for fintech and digital financial services players in Morocco?

Amar: Morocco has indeed lagged behind in the adoption of digital payments, but it’s catching up quickly. We’re currently witnessing very high growth in the use of mobile banking and debit/credit card transactions.

Of course, we’re only at the beginning of the cycle, and the potential is still immense, requiring significant attention from digital financial services players in various sectors such as merchant acquiring, crowdfunding, loyalty programs, BNPL (Buy Now Pay Later), and more.

Operating financial services in Morocco is challenging due to a regulatory framework that adopts a risk-based approach. To operate successfully, any entity must strive to be highly compliant, addressing regulatory requirements comprehensively. This is crucial for instilling confidence in stakeholders regarding any potential risks arising from the financial activities.

CASH PLUS seems like a traditional MTO (like Western Union) that continues to become more digitized. Is that an accurate assessment? How does the company combine technology and financial services to create value for end users today, and how will that change in the future?