Blitzscaling in African markets: Opera's OPay optimizes its operations

After some setbacks in sub-Saharan Africa, the Sino-owned super app changes its strategy

Afridigest provides ideas & analysis for startup founders, operators, and investors across Africa and beyond.

This post explores OPay, the Chinese-owned super app operating in Nigeria.

If you’re new, welcome 🙌 — you’ll generally receive 2 weekly Afridigest emails: an original essay (on Saturdays generally) and the weekly digest (every Monday). For past essays and digests, visit the archive.

Introduction

Recently, OPay, the Chinese-backed super app operating in Nigeria made an announcement that garnered plenty of attention.

Best known for its lime-green ‘Uber for motorcycle taxis’ service, the company, which is backed by Softbank and Meituan Dianping (China’s other super app), announced the suspension of its ride-hailing & logistics services, ORide, OCar, and OExpress.

And while not explicitly named in the company’s statement, OFood, the company’s food delivery service, has been suspended as well. (The OFood service has been removed from the app, and the Twitter account has been deleted.)

OPay, as the name suggests, will focus on payments and financial services offerings, and the company “will continue to invest in and grow” its e-commerce offerings, OMall (B2C) and OTrade (B2B).

A history of OPay

A look at Opera’s financial statements suggests that, legally speaking, OPay (“OPay Digital Services Limited”), was co-founded in November 2017 by Opera, makers of the internet browser, and Balder Investment Inc., an entity controlled by Opera chief executive and chairman, Yahui Zhou. Zhou has served as Opera CEO & chairman of the board since July 2016 when a consortium of Chinese investors including Beijing Kunlun — a company he founded and led — acquired Opera’s brand, internet-browser operations, and consumer business for $600 million; he controls over two-thirds of Opera via his 19.5% personal stake and Beijing Kunlun’s 48% stake.

According to financial statements, Opera contributed $4.97 million in 2017 for an initial 19.9% stake of OPay, suggesting an initial valuation of ~$25 million. And in July 2018, Opera went public on the NASDAQ stock exchange.

According to Opera, by the end of 2018 OPay had recruited 3,000 mobile money agents and reached an average daily transaction volume in excess of $1 million.

One year later, OPay had recruited 140,000 mobile money agents and reached an average daily transaction volume in excess of $10 million. Its 2019 revenue grew almost 20x y/y to $16.7 million. And on the other side of the equation, OPay recorded a net loss of $71.5 million, a ~188x increase y/y, largely due to its over $41 million cost of revenue.

Opera’s filings explain than $36 million of this was “related to the launch and scaling of ORide to become the dominant ride-hailing service in Lagos, including incentives to attract drivers in this initial period of operations.” Indeed in 2019, largely in the second half of the year, the company launched ride-hailing services ORide, OCar, OBus, and OTrike, and food-delivery service, OFood.

In April 2019, Opera and Balder Investment sold OPay shares to facilitate an employee equity pool ahead of external investment, ultimately reducing Opera’s stake in OPay from 19.9% to 13.1%. That external investment arrived in June 2019 with OPay raising a $50 million Series A round from top tier Chinese VCs including Sequoia China.

The funds raised, according to a contemporaneous press release, would be “used by OPay to continue its growth in mobile payment services, expand into adjacent verticals, including the motorbike ridesharing service ORide and food delivery service OFood, and ultimately expand to additional African markets beyond its core market of Nigeria.”

Just a few months later in November 2019, the company raised a $120 million Series B round whose investors included Chinese super-app Meituan-Dianping and SoftBank Ventures Asia (Softbank’s Asia-focused vehicle for early-stage companies, as opposed to its more famous/infamous Vision Fund for late-stage companies). At the end of the year, OPay was valued on Opera’s books at well over $300 million.

At the time, the company explained in a press release that the new capital would be used “to further accelerate its expansion across multiple verticals, as well as [enter] new African markets.” And when asked by Techcrunch about how the company planned to deploy the $120 million, Opera CFO Frode Jacobsen divulged that the company “want[s] to focus … on things that have high-frequency usage” — transportation services, food services and other types of daily activities — not bill payments and airtime purchases.

The optimism that surrounded OPay’s planned scaling of new, ‘high-frequency’ verticals at the end of 2019 would soon fade, however. In February 2020, without much warning, the Lagos state government banned motorcycle and tricycle taxis from operating in the state’s main commercial centers.

Although OCar could still operate in Lagos, the service never gained real traction; it faced significant competition from Uber and Bolt/Taxify who had developed loyal driver and user bases. And while it’s true that OPay expanded out of Lagos to many of Nigeria’s other top 15 most populated cities, Lagos with its purported population of 20 million remained the crown jewel for the company.

So, Lagos’ February proscription dealt a significant blow to OPay. As a result of this new regulatory regime, the company’s previously stated goal of “scaling ORide to become the dominant ride-hailing service in Lagos” was rendered unrealizable.

The company has since tried to save face however, with Nigeria Country Manager Iniabasi Akpan, declaring that ORide was “just one of the enablers” of the company’s payments services.

While it’s true that ORide and OFood contributed to the growth of OPay’s payment vertical, one simply has to look at the company’s past statements and almost $40 million spend on ORide to understand the importance internally, pre-ban, of the company’s so-called ‘enabling’ services. In particular, the company’s emphasis on the transportation and food delivery verticals in its post-fundraising press releases suggests that the company’s investors were persuaded by a strategy anchored upon expanding these verticals. Furthermore, it strains credulity to think that the company’s original plan involved selling motorcycles to the public.

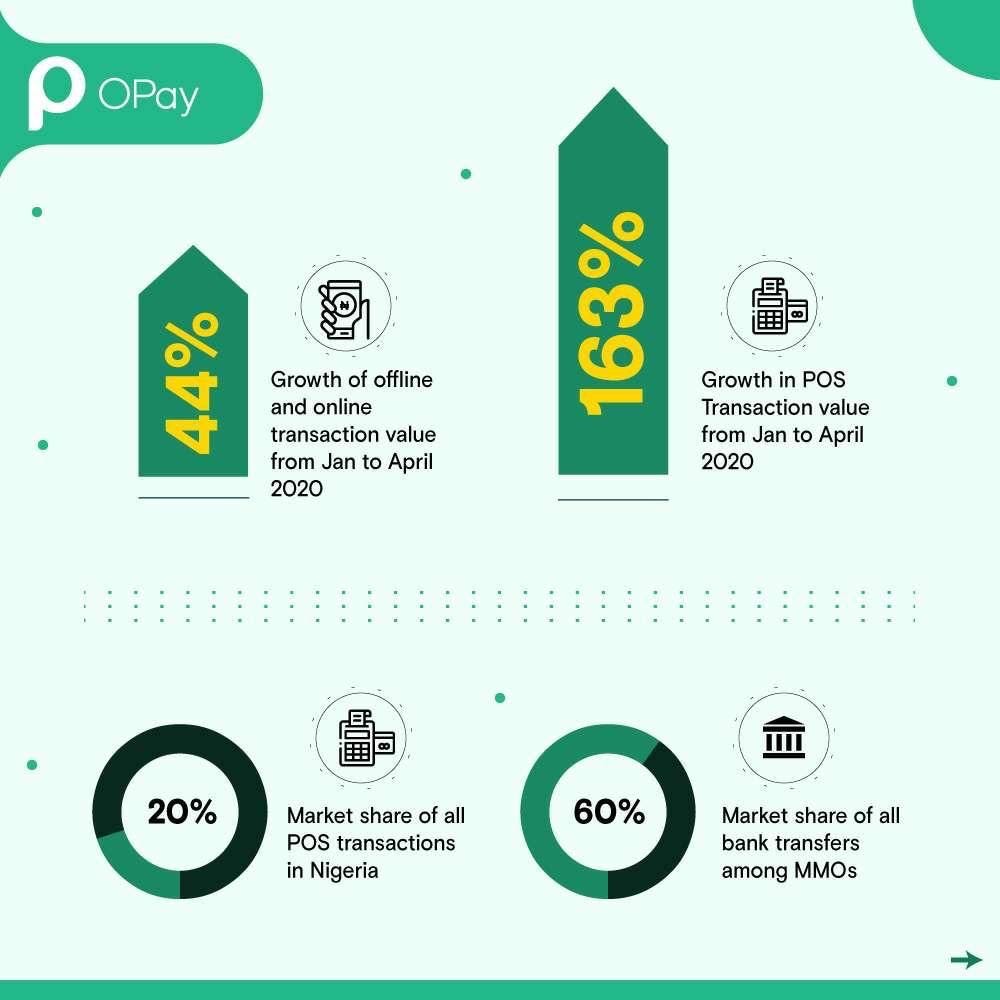

Despite these challenges, however, OPay appears to be in an enviable position relative to payments as Akpan alludes to. The company claims to now have over 5 million users, up from ~100,000 a year ago, and 300,000 mobile money agents, up from 140,000 at the end of 2019.

The company also claims, according to Techcabal, that OPay now accounts for over 60% of mobile money transaction value and volume in Nigeria.

Still, one indicator of the continued precariousness of the company’s position is the recent activity of its CEO. In April, chief executive Yahui Zhou resigned from his long-held role as Chairman of Beijing Kunlun Tech — the Chinese conglomerate he founded — due to a “need to invest more time and energy in Africa and OPay,” according to a Chinese-language company filing. He’d previously held the chairmanship of Beijing Kunlun Tech and the Opera CEO role simultaneously without issue, but apparently the Nigeria situation caused enough concern that it obliged him to step down, explicitly naming OPay as the reason.

In 2019, the South China Morning Post noted that “only a darling of the Chinese tech world like Zhou Yahui could bring in heavyweights like Meituan Dianping, IDG Capital and Sequoia China.” Not up to a year later, Zhou is presumably under significant pressure to prevent the darling from turning into a dolt.

OPay timeline

2011: Opera which had seen significant usage in Africa since 2006 signaled its full-throated commitment to the continent as it signed deals with various African telcos including MTN Group, Airtel, Vodacom Tanzania, Kenya’s Safaricom, MTN Rwanda, and more

February 2016: Beijing Kunlun Tech, Qihoo, and other Chinese investors bid $1.2 billion for Opera, but the deal fails to get approval

July 2016: Beijing Kunlun’s billionaire founder & CEO, Yahui Zhou, becomes Opera’s CEO & Chairman of the board

May 2017: Opera announces plans to invest $100M in Africa over the next two years

Sep 2017: Opera begins testing a service called Opay in Kenya

November 2017: Opera and Balder Investment found OPay Digital Services Limited, colloquially known as OPay

Dec 2017: Opera launches the OPay digital wallet in Kenya as an integration with the Opera Mini web browser

March 2018: OPay launches the OKash micro-lending service in Kenya

June 2018: Yahui Zhou resigns from his CEO role at Beijing Kunlun due to Opera’s upcoming IPO

July 2018: Opera goes public and begin trading on the NASDAQ under ticker ‘OPRA’

August 2018: OPay launches its mobile payment service in Nigeria, focusing on its agent network

December 2018: Opera acquires OKash from OPay for $9.5 million

May 2019: OPay launches its motorcycle taxi-hailing service, ORide

August 2019: OPay launches its food service, OFood, in Lagos

August 2019: OPay launches its bus hailing service, OBus

August 2019: OPay launches its tuk-tuk/tricycle-hailing service, OTrike

November 2019: OPay launches its car-hailing service, OCar

February 2020: The Lagos state government bans motorcycle taxis (called ‘okadas’ locally) from operating in key commercial areas

March 2020: Opay launches the e-commerce services OMall (B2C) and OTrade (B2B)

July 2020: OPay suspends part of its transport, logistics, and food delivery operations in Nigeria to focus on payments & e-commerce

Blitzscaling in African markets

Reid Hoffman and Chris Yeh define blitzscaling as “a strategy and set of techniques for driving and managing extremely rapid growth that prioritize speed over efficiency in an environment of uncertainty” in their book of the same name. The approach replaces the concept of first-mover advantage with that of first-scaler advantage, putting forth that many technology markets are winner-take-all or winner-take-most. Thus, the first company to achieve massive scale wins—achieving the kind of market dominance seen by Apple, Amazon, Facebook, Microsoft, and Google.

In markets like these, the principal risk isn’t inefficiency but rather playing things too safe. So, blitzscaling startups need to be bold and “take on far more risk than a company going through the normal, rational process of scaling up.”

OPay’s actions in Nigeria are best understood and analyzed through a blitzscaling lens. Indeed, OPay seems to have viewed (and perhaps still views) the Nigerian market as winner-take-all or winner-take-most. Consequently, its aggressive moves and disregard for unit economics can be seen as logical and in fact appropriate, if one believes a) that it’s an all or nothing market that confers a significant benefit to the first-scaler and b) that the landscape is ripe for blitzscaling approaches.

Among the principal challenges of deploying blitzscaling approaches in Africa are capital and talent however. Blitzscaling, Hoffman writes, “requires an environment that is willing to finance intelligent risks with both financial capital and human capital.”

As a previously successful entrepreneur & ‘darling’ of the Chinese tech ecosystem, Zhou was able to raise substantial risk capital, $170M, for his bet on Africa from an all-star group of investors, skillfully navigating the financial capital requirement.

The talent obstacle, on the other hand, required a bit more creativity (and a bit of callousness). Unlike Silicon Valley which is replete with personnel experienced in scaling companies, Africa’s talent pool is developing rapidly but still relatively shallow. So to compensate, OPay relied strongly on a strategy of aggressively poaching talent from competitors.

OPay’s approach certainly aligns with the blitzscaling tenet of prioritizing “speed over efficiency in an environment of uncertainty,” but the key unanswered question is whether such an approach is suited for the African markets of today.

For one, it’s unclear whether an approach of deep subsidies will win African customers over the long-term. While OPay spent ~$40M or more on driver incentives, rider incentives, user promotions, and other marketing expenses in 2019 (see, for example, unlimited month-long promotional tricycle trips for 20 naira (~$0.05), unlimited month-long promotional motorcycle trips for 100 naira (~$0.25), promotional car trips for 100 naira, and even meals delivered for 10 naira (~$0.03) all-inclusive), it’s not clear that these promotions resulted in any increase in customer loyalty after the promotions ended. Indeed, anecdotal data suggests that this is a foolhardy approach as customers simply revert to previous behavior once the promotions end.

Another issue is that, according to Hoffman, blitzscaling is better suited for companies with high margins. However given a lack of basic infrastructure, high levels of fragmentation, and low consumer ability to pay, African startups tend to have lower margins than their counterparts in the West.

A third reason to question the wisdom of blitzscaling approaches in African markets is the high levels of heterogeneity. Unlike in Western markets where consumers are largely homogenous along important dimensions and national or regional scaling can be achieved with minimal customization, in Africa, languages, culture, and customer expectations of a product or service can vary widely even within a single country like Nigeria.

Yet another issue is that the levels of uncertainty may be more than bargained for. While Hoffman’s definition of blitzscaling presumes “an environment of uncertainty,” one can look to Lagos State’s haphazard regulatory approach, though admittedly unusual, as an example of what uncertainty can look like on the continent.

All things considered, Tim O’Reilly’s criticism of no holds barred, Silicon Valley-style blitzscaling seems particularly apt here, given the dynamics of many African markets described above. “Blitzscaling isn’t really a recipe for success but rather survivorship bias masquerading as a strategy … Venture-backed blitzscaling [is] far less important…than product and business-model innovation, brilliant execution, and relentless strategic focus. Hypergrowth [is] the result rather than the cause of…companies’ success.”

Final Analysis

While the Lagos State ban and COVID-19 may have provided the impetus for OPay to seek a new strategy, it’s not clear that its blitzscaling approach would have achieved the desired results absent these challenges. Still, the various reports of OPay’s alleged demise seem, to borrow a phrase, to be greatly exaggerated; it’s overly simplistic to consider OPay a failure at this point.

In fact, an interesting parallel here is Uber. In late 2019, Uber made it clear that it wanted to become the West’s first super app. In a blog post, CEO Dara Khosrowshahi laid out the vision: “We want Uber to be the operating system for your everyday life: … whatever you need, we want Uber to be your go-to app.” Since then, however, Uber has pared back its ambitions, selling its Jump scooter unit, ‘deprioritizing’ its digital wallet and fintech projects, shutting down its Incubator, AI Labs, and Uber Works units, and even re-evaluating its autonomous driving unit. Now, after the acquisition of Postmates, the company has a more focused vision of becoming the platform for “delivery of all things” that should prove more sustainable. In any case, it’s clear that, despite the pullback from grander ambitions, Uber’s story is far from finished.

Similarly, OPay’s suspension of its transportation, logistics, and food delivery service offerings should be seen as simply a paring back of its own ambitions to focus on business sustainability. By focusing on its core, and shifting away from a cash-burning blitzscaling approach, OPay should be able to build upon its payment strengths and come out better positioned for the future. It’s certainly still the early days for OPay in Africa.

RECOMMENDED READS

The Blitzscaling Basics - Reid Hoffman and Chris Yeh

Blitzscaling - Tim Sullivan

The fundamental problem with Silicon Valley’s favorite growth strategy - Tim O’Reilly

Thanks for reading 🙌 If you have feedback or questions, let me know by leaving a comment or sending me a DM on Twitter @eajene. If you liked this post, subscribe and share it with your networks. Thanks and see you soon! 👋

The purpose of blitzscaling is to secure enduring market leadership in a valuable industry which allows you decades of profitable operations. Simply growing fast is a means, not an ends. (Chris Yeh, Co-Author of Blitzscaling)

Fantastic Read, love the update to the draft.

An example that moving fast and throwing money at it doesn’t always work in Africa is Jumia and Konga.

Fast execution is important in this market, but so is patience and sustainability.

I have no doubt they will figure it out.

After all Jumia is making a comeback via Payments.

If Opay is shutting down it’s other units to focus on payments,

And Jumia is saying it’s fastest growing unit is payments.

Does it mean the only vertical mature enough for scale in Africa is fintech ?

🤔