Exclusive: The economics of Jumia Food exposed for the first time

Afridigest is your intelligent guide to Africa’s tech ecosystem. We provide ideas, analysis, and insights for startup founders, executives, and investors across Africa and beyond.

Today’s essay is for premium subscribers and offers a never-before-seen look at Jumia Food’s financials.

Happy reading! If you’re new here: welcome — the Week in Review is sent on Mondays, the Fintech Review goes out on Sundays, and other content goes out on Wednesdays and/or Saturdays. For past essays and digests, visit the archive & Afridigest.com.

➜ And if you’re not yet a premium subscriber, upgrade your subscription here.

In the 19th century, thanks to the First Industrial Revolution, London became the largest city in the world.

But its infrastructure was inadequate to handle its population boom and the city was plagued by repeated outbreaks of cholera, a deadly disease that most folks at the time mistakenly believed was spread by “miasmas” — foul smelling fumes.

In 1854, during one such outbreak in London’s Soho district, physician John Snow — considered today as one of the founders of modern epidemiology — conducted his ‘grand experiment.’

He compared cholera death rates in households served by two rival water companies and provided credible evidence that cholera was spread by contaminated water.

His investigation is one of the most famous early examples of a “natural experiment” — an observational study where researchers analyze events that occur naturally, without any prior planning or intervention by the researchers themselves.

Today, Jumia offers the opportunity for a natural experiment of a different kind.

In its recently released fourth quarter and full year 2023 results (PDF), the company made historical adjustments to account for the shutdown of Jumia Food.

As a result, we can now compare Jumia’s 2022 results that include Jumia Food figures to the same results restated to exclude the food delivery business. That gives us Jumia Food’s 2022 financial performance. 💡

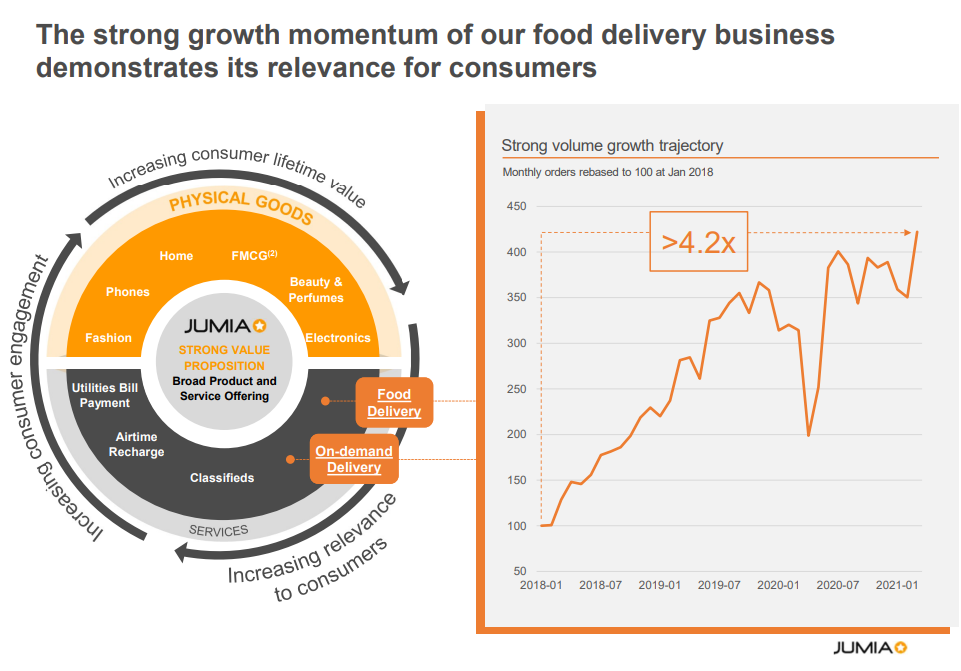

But first, let’s recall that while Jumia Food was “an important growth engine for the platform and [a] key asset in terms of consumer acquisition and reengagement” (according to former Jumia co-CEO Jeremy Hodara), the food delivery business had never been profitable.

And as new Jumia CEO Francis Dufay told Reuters when he announced the death (or murder) of Jumia Food in December:

“It’s a segment that’s very difficult across the world, with very challenging economics and big losses. It’s also a segment that is extremely competitive across the world and Africa. The economics are tough in [Africa] because the costs are very high and there is plenty of competition so there is downward pressure on the commissions that we make and upward pressure on marketing costs because everyone is fighting for customers.”

With that bit of context, let’s now dive into the economics of Jumia Food.