This Afridigest Week in Review is a recap of what happened across Africa's tech ecosystem for Africa-focused founders, executives, and investors.

Welcome back, old & new friends 👋🏽!

According to your feedback, the Afridigest Intelligence Brief on the business of black soldier flies was a banger, so be sure to check it out if you haven’t already. And we’re excited to have Chris Alafaa now helping us here at Afridigest — and it’d be great if you gave him a follow on Twitter or LinkedIn. 🙏🏽 (P.S. I blame him for the delay in today’s newsletter 😀)

📌 ICYMI: Afridigest referrals are live. For a limited time, one successful referral gets you the link to a hard-won website I think you’ll appreciate if you like IPOs: 1) Click the 'Refer a friend' button below to get your custom referral link, 2) Share the link with your friends and colleagues, 3) Earn rewards when they subscribe to Afridigest. 🚀

If you’re new here: welcome — this Week in Review is sent on Mondays, the Fintech Review goes out on Sundays, the Content Corner or Intelligence Brief goes out on Wednesdays, and an original essay occasionally goes out on Saturdays. For past essays and digests, visit the archive & Afridigest.com. And with that said, let’s get into it!

Week 27 2023: July 2-8

SOMETHING FOR READERS IN LAGOS

GrowthCon 1.0 is coming to Lagos on July 21st & 22nd. It’s a first-of-its-kind two-day conference about business growth in Africa. Come to connect with growth leaders, operators, and enthusiasts. And experience curated masterclasses, case studies, a growth hackathon, and more.

Our friends at alGROWithm got their hands on some tickets and they’re sharing the wealth with Afridigest readers — get 50% off your ticket when you use the voucher code AFRIDIGEST at checkout.

I have my ticket & I hope to see you there. But don’t wait too long, the code is valid only for the first 20 Afridigest readers to use it.

🔦 Equity & Debt FundraisesIf you’d like us to know about a fundraise, please submit it here:

💰 Investor ActivityKnife Fund III, the $50M fund from Knife Capital focused primarily on Series B tech startups in South Africa, reached its final close. LPs include the IFC, Standard Bank, and the SA SME Fund.

Goodwell Investments’ uMunthu II Fund secured $10.8M from Invest International. The fund previously announced a ~$61M first close and has a ~$160M target. Portfolio companies include Copia and Sendy.

Subject to shareholder approval, Kenya’s Safaricom plans to establish two VC firms to invest in seed-stage and growth-stage businesses.

African Union agency heads announced plans for a VC fund and a ‘4D initiative’ to support the local production of advanced technologies with critical social impact — like biotech and AI.

🕵️♀️ In case you missed itNEWS

Nigerian healthtech Medsaf laid off all of its full-time employees (~30 people). This would have just been the latest development in a long string of downturn-driven downsizing, but Medsaf pushed back on the reporting. The company’s CEO alleged that the coverage was “full of lies, misinformation, and slander” while providing few specifics. Tofino Capital’s Eliot Pence probably has it right about what triggered the response here:

Meet the seven African tech startups selected to the World Economic Forum (WEF)’s list of 100 most promising tech pioneers of 2022.

OTHER ARTICLES

Why a growing number of Chinese investors are looking to Africa’s tech space (SCMP)

WhatsApp voice notes are revolutionizing farming in Senegal (Rest of World)

Inside Madagascar’s fledgling startup ecosystem (TechCabal)

Africa: mobility and decarbonization, a difficult equation? (Afrik21)

Remember, the Afridigest referral program is now live. And for a limited time, one successful referral gets you the link to one of my favorite websites. It’s a good one (if you like IPOs), and most people have never heard of it 🤗

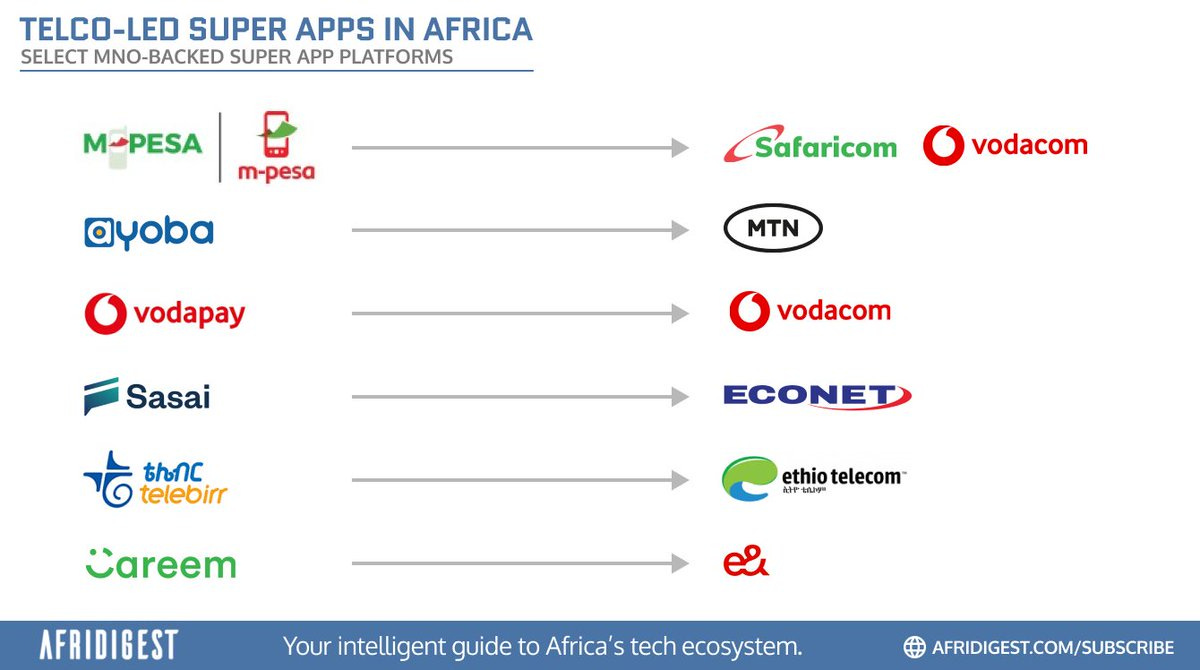

👀 Visual of the WeekSome of the biggest opportunities across Africa today are in fintech, and the sector has led tech investment in Africa for several years now.

🐤 Tweets of the WeekChance favors the prepared mind:

A solid marketing tweet that speaks from first-hand experience:

Do you agree or disagree:

Bonus: VCs get to make 5+ bets a year and founders get to make 1 bet every 5+ years.

🗣️ Community Corner and Opportunities (feel free to send yours in)🎰 OPPORTUNITIES

African startups are invited to apply before July 31st for the second cohort of the (Microsoft/Flapmax) FAST accelerator. B2B startups are prioritized, but Healthcare, Fintech, Edtech, and Industrials/Agtech startups are specifically of interest. Sustainability and Deeptech are also welcomed.

The last word

💭 Just my thoughtsYou can’t outzuck the Zuck.

That’s the lesson of the week.

I tried to think of what really mattered in African tech cette semaine, but it was hard to beat Facebook/Meta’s launch of Twitter rival Threads, regardless of one’s geography.

Now, I’ve been a huge fan of Twitter since forever — I joined the platform a year after it launched — but I’m not really a fan of Elon Musk’s Twitter (particularly since the platform started penalizing tweets containing ‘substack’ or links to the domain.)

So, seeing Threads’ initial traction certainly piqued my interest. (And you can follow me there at @eajene if you’re interested.)

It reminded me of a dinner conversation earlier this year with Thibaut from Axian, Ike & Ovo from Beta Ventures, and Julian from BFREE where Julian and I made a gentleman’s bet on Twitter's future. (I was bearish, he was bullish.)

But let’s bring it back to Africa Tech.

Threads leverages Instagram’s distribution. And if you think about who enjoys the broadest consumer distribution across Africa’s tech ecosystem today, you’ll probably land on telcos. It’s no surprise then that they’re increasingly leveraging this advantage to launch super apps of various kinds — which reminds me that I need to publish this article sooner than later.

That said, one of my favorite genres of business writing is articles like ‘What Taylor Swift can teach us about business.’

And it strikes me that there’s a decent article to be written here of the sort, ‘what African founders can learn from the Threads launch.’

Ping me if you decide to write it — we might want to publish it on Afridigest.com 👀

Thanks for reading Afridigest 💌 Be sure to refer a friend!

Tell me what you thought of today’s newsletter:

😡 Hated it • 😑 Meh • 😃 Loved it

✨ The rest of this newsletter contains details on founders, announced fundraises, and M&A deals, and is available to premium members of Afridigest whose support makes this work possible. ✨