Afridigest Week in Review: Snow in Jozi

Afridigest is your intelligent guide to Africa’s tech ecosystem. This Afridigest Week in Review helps you stay in the know about what happened in Africa Tech last week.

Welcome back, old & new friends 👋🏽!

📌 A lot of you weren’t huge fans of the curated content email last week, so we’ll give it one or two more tries before giving the format the ax 🪓. As always, your feedback goes a long way towards shaping what we do here 🙏🏽

If you’re new here: welcome — this Week in Review is sent on Mondays, the Fintech Review goes out on Sundays, the Content Corner or Intelligence Brief goes out on Wednesdays, and an original essay occasionally goes out on Saturdays. For past essays and digests, visit the archive & Afridigest.com.

Oh, there likely won’t be any Wednesday email this week as we focus on a Saturday essay.

And with that said, let’s get into it!

Week 28 2023: July 9-15

NEW ON AFRIDIGEST.COM

50 African tech startups raised ~$100M in June. Our listing of startup fundraises announced across Africa last month.

Platforms are the future of Africa’s mobile money agents. An opinion piece from Tembo Co-Founder & COO Reuben Mwatosya on the future of mobile money agents in Africa.

📢 We accept & are actively calling for op-eds/essays from industry leaders for publication on Afridigest.com. Our focus is on ideas, insights, and/or analyses that help readers succeed in building the continent's future. Get in touch: submissions@afridigest.com.

🔦 Equity & Debt FundraisesSend us your fundraising announcements to us via the form below:

💰 Investor ActivityGlobal private investment firm LeapFrog Investments announced plans to commit $500M to companies combating climate change in Africa and Asia.

LeapFrog last led the $70M Series D extension round of pan-African off-grid solar energy provider Sun King in Week 50 2022.

“Investing in climate solutions across emerging markets is not just the right thing to do, but also a highly compelling commercial opportunity.” — Dr. Andy Kuper, LeapFrog’s Founder & CEO.

The European Investment Bank is considering a $30M investment in TLcom Capital’s $150M-target Tide Africa II fund.

The fund will make initial investments primarily in seed-stage rounds of African startups in the financial services, consumer services, B2B services, SME software, and connectivity sectors.

Tide Africa II has successfully raised at least $103.5M so far from AfricaGrow, CDC/BII, IFC, Proparco, SwedFund, the African Development Bank, BIO, Visa Foundation, BPI France, Bertelsman, King Philanthropies, and FBN Quest.

Tamwilcom, a Moroccan state-backed financing initiative, launched a new edition of its Innov Invest Fund (F2I) for Moroccan startups.

🕵️♀️ In case you missed itNEWS

Kenya approved the draft charter for the Open University of Kenya which will establish the first fully-fledged online university in Kenya. While private online universities like Nexford aren’t new to African students, this is said to be the first public university of its kind on the continent. And some see this as the start of a new normal for education across Africa. (Business Daily)

Telcos e& and Orange are considering bids for a 45% stake in state-owned Ethio Telecom. And e& is also exploring a bid for the new telco license being offered in the country. The liberalization of the telco sector in Ethiopia, Africa’s second most-populous country, is worth paying attention to. (Zawya)

OTHER ARTICLES

Africa’s gaming market is expected to top $1 billion in 2024 (CNBC)

For francophone startups playing catch-up, imitation is the cheat code (TechCabal)

Why logistics matters for embedded marketplaces (Accion)

African farming draws low volume of VC investments (Forbes Africa)

Ride-hailing drivers in Nigeria are suffering after government triples fuel prices (Rest of World)

Uganda joins band of African nations requiring Big Tech to pay taxes (Semafor)

The Afridigest referral program is live and for a limited time, one successful referral gets you the link to one of my favorite websites. It’s a good one (if you like IPOs) — and there’s a good chance 99% of your colleagues have never heard of it 💡

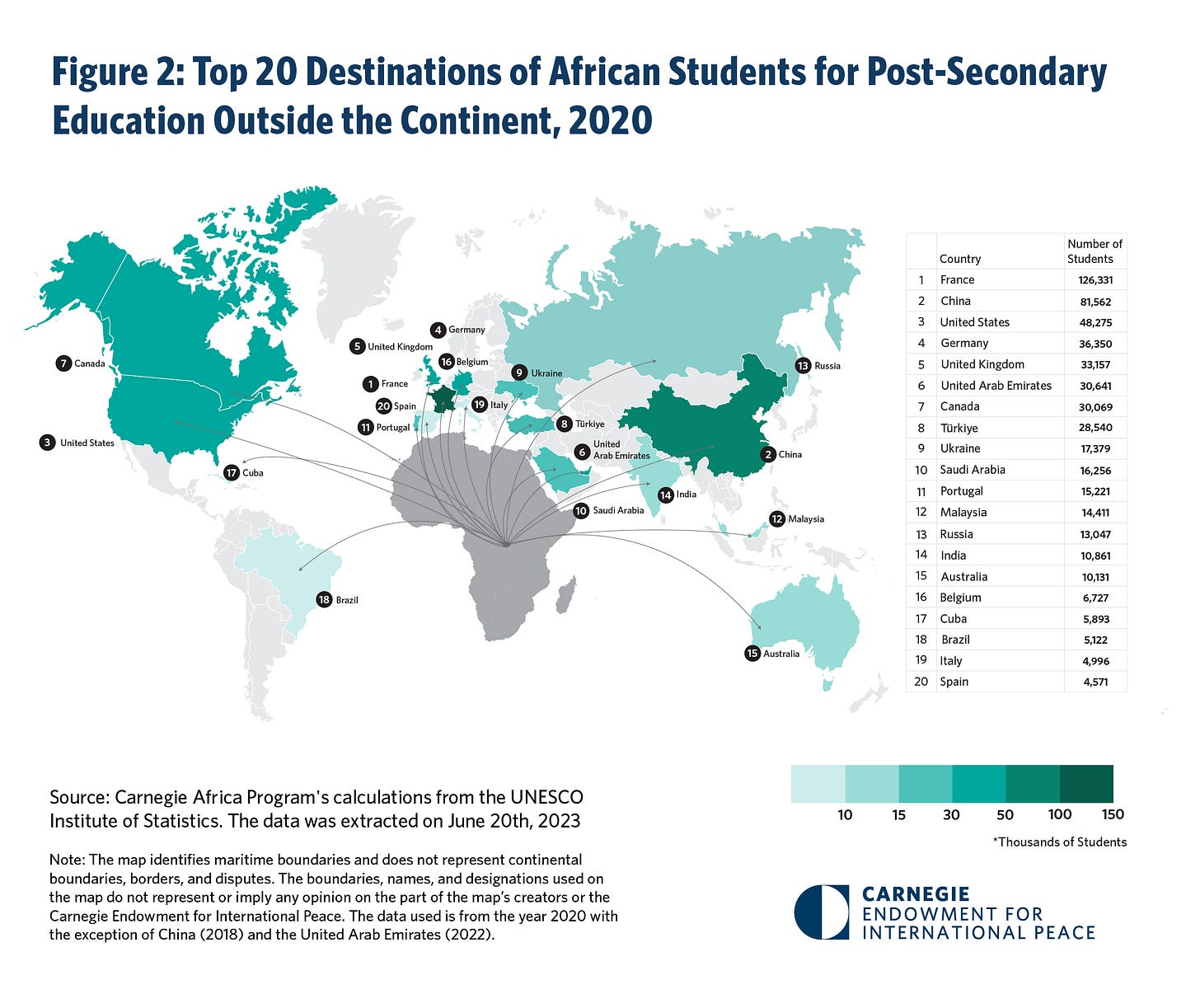

👀 Visual of the WeekI wrote about the accelerating brain drain a couple of weeks ago, and here’s a look at the top destinations for African students pursuing higher education abroad.

One trend worth watching: an apparent shift away from former colonial powers like Belgium, Portugal, and the UK towards “emerging economies and middle powers” like Turkey, the UAE, and Malaysia.

🐤 Tweets of the WeekOn focus, economies of scope, and survival:

Reminds me of my arguments here about early expansion across the continent as a hedge against regulatory, political, and economic uncertainty.

And it also reminds me of this World Bank report from last year: “Firms in developing countries are using platform-based or data-driven business models to realize scope economies and create value, especially in e-commerce and fintech.”

🗣️ Community Corner and Opportunities (feel free to send yours in)🎰 OPPORTUNITIES

African startups that have raised less than $250K are invited to apply before August 31st to the OST Grow investment readiness program. Developed in collaboration with AfricaGrow, BPI France, Go Ventures, and Africinvest, it’s a 12-month program designed to help startups raise their first $1M, gain exposure to national and regional investors, and expand their businesses in new markets.

The last word

💭 Just my thoughtsIt snowed in Johannesburg for the first time since August 2012 and that’s an apt metaphor for…

…er, I got nothing this week. 😄

I thought about making a link to the rise of climate tech across Africa, but it felt like a bit of a stretch.

So, instead, here’s a photo that I appreciated:

(And you can see others here.)

Thanks for reading Afridigest 💌 Be sure to refer a friend!

Tell me what you thought of today’s newsletter:

😡 Hated it • 😑 Meh • 😃 Loved it

✨ The rest of this newsletter contains details on founders and announced fundraises, and is available to premium subscribers whose support makes this work possible. ✨