Afridigest Week in Review: The best moats in African tech?

Afridigest is your intelligent guide to Africa’s tech ecosystem. This Afridigest Week in Review helps you stay in the know about what happened in Africa Tech last week.

Welcome back, old & new friends 👋🏽!

📌 Mea culpa. The Saturday essay didn’t happen, but it’s coming this week — maybe as soon as tomorrow. But I need your help: who do you think has the strongest moat in African tech and why? 🤔 A quick note will go a long way 🙏🏽

If you’re new here: welcome — this Week in Review is sent on Mondays, the Fintech Review goes out on Sundays, the Content Corner or Intelligence Brief goes out on Wednesdays, and an original essay occasionally goes out on Saturdays. For past essays and digests, visit the archive & Afridigest.com.

And with that said, let’s get into it!

📢 Spread the word: African startups that have raised less than $250K are invited to apply before August 31st to the OST Grow investment readiness program.

Week 29 2023: July 16-22

NEW ON AFRIDIGEST.COM

CFO automation: An unsexy but lucrative corner of African fintech. An overview of the opportunity in CFO automation across Africa from First Circle Capital Managing Partner Selma Ribica.

📢 We accept & are actively calling for op-eds/essays from industry leaders for publication on Afridigest.com. Our focus is on ideas, insights, and/or analyses that help readers succeed in building the continent's future. Get in touch: submissions@afridigest.com.

🔦 Equity & Debt Fundraises(Nigerian insurtech platform Gamp also officially announced its $650K pre-seed this week, but we previously covered the round — amount undisclosed at the time — in Week 30 2022.)

Send your fundraising announcements to us via the form below:

💰 Investor Activity500 Global and The Egyptian Information Technology Industry Development Agency (ITIDA) announced the launch of the 500 Global Scale Up program. It’s a non-investment program for pre-Series A and Series A Egyptian startups.

🔥🪑 In the Hot Seat with Startup Wise Guys' Petra WolkensteinFounded in 2012, Estonia’s Startup Wise Guys is one of the most active early-stage investors in Central & Eastern Europe and the Nordics.

The accelerator-cum-investment fund expanded to Africa in 2021 and now boasts a portfolio of ~16 African startups including Kenyan investment platform Hisa, Nigerian revenue optimization platform Bunce, and Tanzanian save-now-buy-later platform Tunzaa.

In this week’s Hot Seat feature, I caught up with Petra Wolkenstein, a GP of the SWG Africa Fund, to learn more about the fund’s SaaS focus in Africa.

Pair with: Where is the SaaS revolution in Africa?

P.S. African B2B SaaS fintechs, agtechs, and climate-techs are invited to apply before September 7th to the next batch of the Startup Wise Guys SaaS Accelerator Program: Africa.

🕵️♀️ In case you missed itOTHER ARTICLES

Can Africa deliver on its ambitious digital transformation goal? (Computer Weekly)

Is debt financing ideal for African startups in a funding winter? (Benjamin Dada)

Twitter laid off most of its workers in Africa last year. They say they’ve been ignored and left without severance (CNBC)

Addressing customs and border operations with digitalization (Leadership NG)

Ripe for disruption: Africa’s big leap in agritech (Forbes Africa)

New visa programs spark brain drain fears across Africa (Rest of World)

Why not refer a friend to Afridigest and get credit for it?

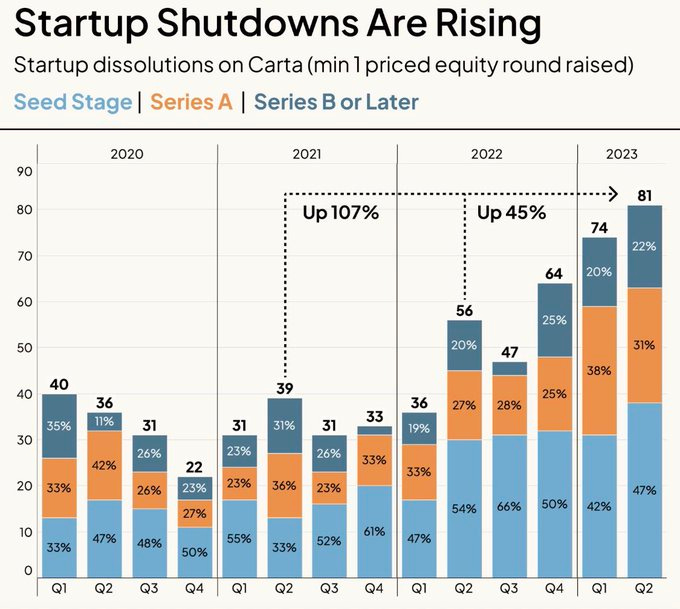

👀 Visual of the WeekData from cap table management platform Carta shows a steady rise in startup shutdowns over the last six quarters.

(Note that the data doesn’t include shutdowns of startups that never raised a priced round.)

🐤 Tweets of the WeekOn startup recruiting:

On the return to the first principles of de-risking startups step-by-step:

On ignoring commonly held wisdom:

Bonus: Founders should use memos more often instead of pitch decks. Venture capital isn’t built for outsiders.

🗣️ Community Corner and Opportunities (feel free to send yours in)🎰 OPPORTUNITIES

Early-stage women founders from across the continent are invited to apply for an all-expenses paid trip to Nairobi to pitch at the Women Who Build Africa (WWBA) Assembly from Sept 12th through the 14th. WWBA is a hub & community for women working in tech across African markets, and the WWBA Assembly is its first major event. Potential partners and sponsors are encouraged to get in touch via the form as well.

Early-stage African fintech, mobility, e-commerce, and talent tech founders are invited to apply before August 9th to the 2023 ARM Labs Lagos Techstars Accelerator program. The program offers $20K in exchange for 6% equity and an optional $100K convertible note.

The last word

💭 Just my thoughtsI was on a GrowthCon panel last Friday with

and he talked about how he repeatedly receives pitch decks hawking cross-border payment solutions with little to no differentiation.It reminded me of

Dozie’s piece earlier this year on “copy and paste strategies” that lead founders across Africa to worship at the altar of payments & digital banking.Success breeds copycats, and one of Ngozi’s points was that the recent fundraising fortune of payments/banking startups has led — rationally — to heightened founder interest in building payments/banking startups.

But my thoughts here aren’t about payments, but rather moats.

In a world of copycat ideas, business moats matter especially.

And I’ve been chewing on some ideas about moats in African tech for a couple of weeks now.

But I’d like your help. So, dear reader, what are the best/strongest business moats you’ve seen in African tech? 🧐

There’s a good article (or two) to be written here, for sure — and it’d add a lot of value to readers. 🙏🏽

Thanks for reading Afridigest 💌 Be sure to refer a friend!

Tell me what you thought of today’s newsletter:

😡 Hated it • 😑 Meh • 😃 Loved it

✨ The rest of this newsletter contains details on founders and announced fundraises, and is available to premium subscribers whose support makes this work possible. ✨