Afridigest Week in Review: What do Jumia & Chipper Cash have in common?

Afridigest is your intelligent guide to Africa’s tech ecosystem. This Afridigest Week in Review helps you stay in the know about what happened in Africa Tech last week.

Welcome back, old & new friends 👋🏽!

📌 In today’s edition, we put DFS Lab’s Stephen Deng in the Hot Seat to talk about 'the 3Fs.' We shine a light on the mirage of Africa’s middle class. And we take a quick look at last week’s news on Jumia & Chipper Cash.

And in case you missed it, the H1 2023 update to the fintech transactions database went out on Saturday.

If you’re new here: welcome — this Week in Review is sent on Mondays, the Fintech Review goes out on Sundays, and additional content goes out on (some but not all) Wednesdays/Saturdays. For past essays and digests, visit the archive & Afridigest.com.

And with that said, let’s get into it!

Week 33 2023: Aug 13-19

BROUGHT TO YOU BY:

Research & advisory firm Africreate offers reliable, intelligence-led solutions to decisionmakers.

🔦 Equity & Debt FundraisesSix deals were announced for a total of ~$33M in disclosed funding this week.

Full details are available below after the paywall.

💰 Investor ActivitySouth African early-stage investor and accelerator Founders Factory Africa (FFA) announced that it raised $114M from Mastercard Foundation and Johnson & Johnson Impact Ventures.

FFA provides up to $250K in equity to startups at the idea, pre-seed, and seed stages, plus up to $150K in nondilutive funding, as well as additional operational support.

Since its launch in 2018, FFA has supported 55 startups across 11 African countries, including Uganda’s Asaak, Nigeria’s Winich Farms, and Rwanda’s Viebeg.

🔥🪑 In the hot seat with DFS Lab's Stephen DengDFS Lab is an early-stage investor and accelerator focused on the next generation of digital commerce across Africa. Its portfolio includes Nigeria’s Bumpa, Kenya’s Pezesha, and Tanzania’s Nala. I caught up with its Co-Founder & Managing Partner Stephen Deng in this week’s Hot Seat feature.

🕵️♀️ In case you missed itNEWS

Kenyan B2B e-commerce platform Twiga Foods underwent a “corporate transformation initiative” that saw it lay off a third (~283) of its 850 employees.

Elsewhere in Kenya’s B2B e-commerce space, MarketForce turned to crowdfunding for “a small community funding round” of up to $1M.

OTHER ARTICLES

Nigeria’s sliding currency leaves foreign-backed startups in limbo. (Forbes)

Unlocking Africa’s economic resurgence: Can the Middle East’s investments hold the key? (Arab News)

African podcasters are now recognized globally. Can they transform this success into a viable business? (Reuters Institute)

Shein is the most downloaded shopping app on South Africa’s Google Play store, and it isn’t even trying that hard. (Bloomberg/News24)

Outsourcing company Sama regrets taking Facebook moderation work. (BBC)

Prosper Chikomo, founder and chief empowerment officer at Prosper on Farms, writes ‘Africa’s smallholder farmers need access to irrigation technologies before 4IR agtech solutions can take off’ (AgFunder News)

Spread the love. Share Afridigest with a friend.

👀 Visual of the WeekTHE MIRAGE OF THE MIDDLE CLASS

People love to talk about Africa's ‘fast-growing middle class.’

That tends to be part of an ‘invest-in-Africa-now!’ narrative used to separate (naive?) investors from their money.

But that’s based on old data.

Here's the reality today: growth stalled over the last decade.

While consumer expenditure across Africa is on the rise, most of that's driven by population growth — not rising incomes.

That’s not to say that there aren’t reasons to be excited about opportunities across Africa — they’re plenty of them. But being a realistic optimist is recommended. (Shout out to Tim Motte.)

So, why does Africa’s ‘magic middle class’ continue to be promoted today?

Well, “it's difficult to get a man to understand something when his salary depends on his not understanding it.”

🐤 Tweets of the WeekA throwaway phrase from one of Paystack’s co-founders became a meme used by brands & individuals alike:

Seem like more & more founders are quoting scripture these days but in any case, I agree with this message:

Lastly, some interesting thoughts here about Transsion. (Pair with our intelligence brief on Africa’s smartphone market.)

Bonus:

Founders now need to become outliers at the earliest stages.

A thread worth reading on existing investors participating in inside rounds.

🗣️ Community Corner and Opportunities (Send to submissions@afridigest.com)🎰 OPPORTUNITIES

Early-stage African blockchain startups are invited to apply before November 30th to the 6th batch of the CV Labs accelerator program. CV VC may invest up to $135K in exchange for 7% equity (and/or 4% future token supply) of selected startups.

The last word

💭 Just my thoughtsACT 1

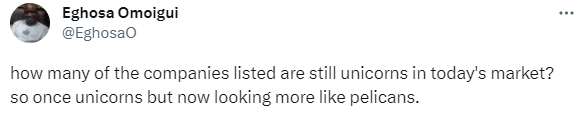

What do you call a unicorn that loses its horn?

That was a question I posed in Week 16’s newsletter and it came up again this week, thanks to this Forbes profile of cross-border payment platform Chipper Cash — an (erstwhile?) member of Africa’s unicorn list.

The piece is definitely worth a read and it brought to my mind several aspects of company building. But I think most people paid more attention to the “deep valuation cut,” so here’s the relevant snippet:

I don’t have much more to say about Chipper right now, so I’ll return to the question at the start of this section: What do you call a unicorn that loses its horn?

A pelican?

ACT 2

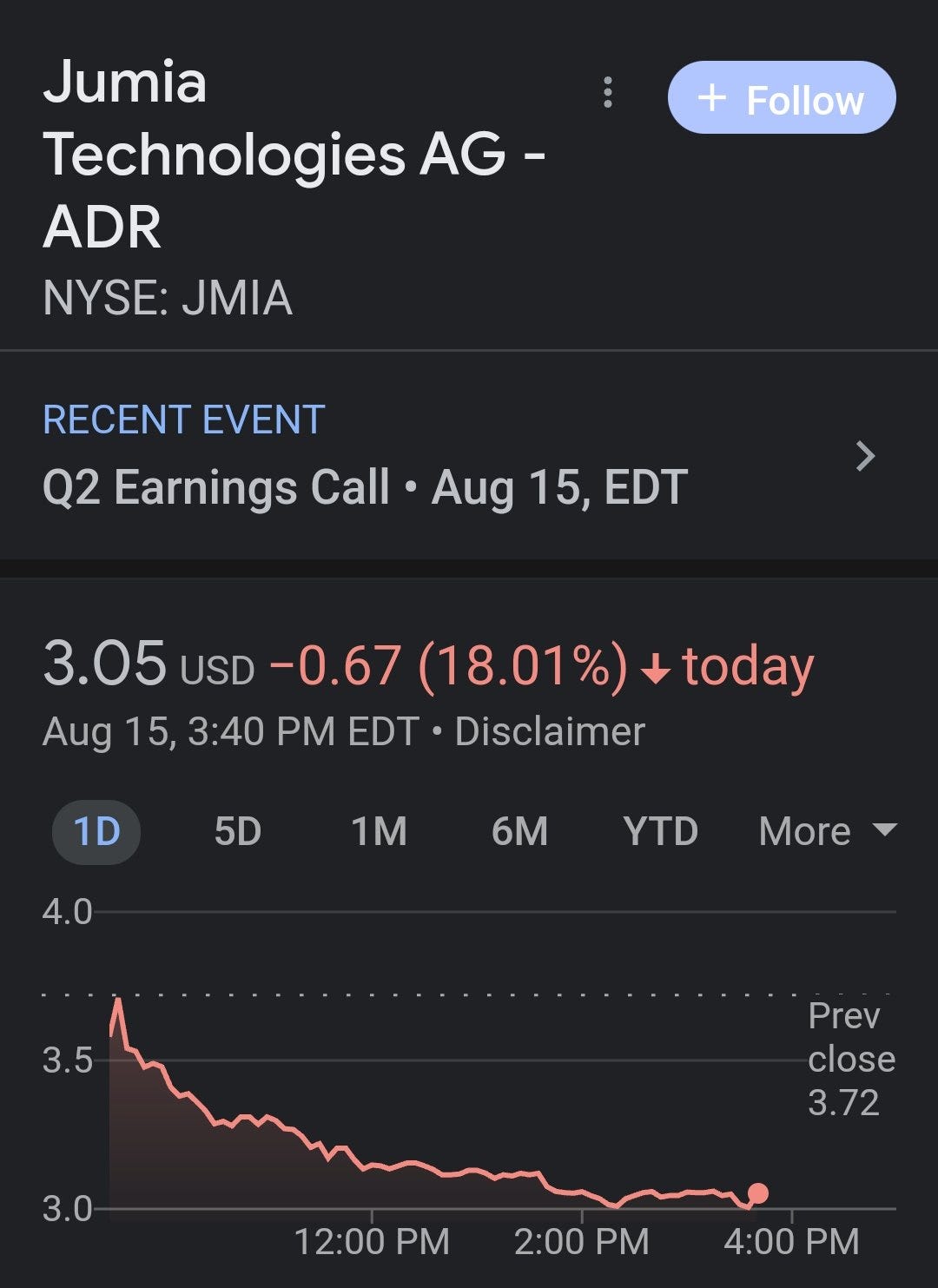

Elsewhere in the news last week, Jumia released its Q2 2023 earnings and the market reacted negatively.

I’ll point you to the thoughts I shared on Linkedin last week, including my opinion that Jumia's 'Amazon of Africa' vision is dead.

ACT 3

What do Jumia and Chipper Cash have in common?

Well besides being former billion-dollar companies, the two now seem firmly focused on cost reductions and the path toward profitability.

He who has ears to hear, let him hear.

Tell me what you thought of today’s newsletter:

😡 Hated it • 😑 Meh • 😃 Loved it

And reach me via WhatsApp, Twitter, LinkedIn, or email.

✨ The rest of this newsletter — which contains details on announced fundraises — is available to premium subscribers whose support makes this work possible. ✨