Afridigest Week in Review: Africa doesn't exist

Afridigest is your intelligent guide to Africa’s tech ecosystem. This Afridigest Week in Review helps you stay in the know about what happened in Africa Tech last week.

Welcome back, old & new friends 👋🏽!

📌 Many thanks to new paying subscribers — and to old ones too, of course 🙏🏽 Deeply appreciate your support and please expect an email from me this week!

If you’re new here: welcome — this Week in Review is sent on Mondays, the Fintech Review goes out on Sundays, the Content Corner or Intelligence Brief goes out on Wednesdays, and an original essay occasionally goes out on Saturdays. (But please note: Wednesday & Saturday content is very much in flux right now.) For past essays and digests, visit the archive & Afridigest.com.

And with that said, let’s get into it!

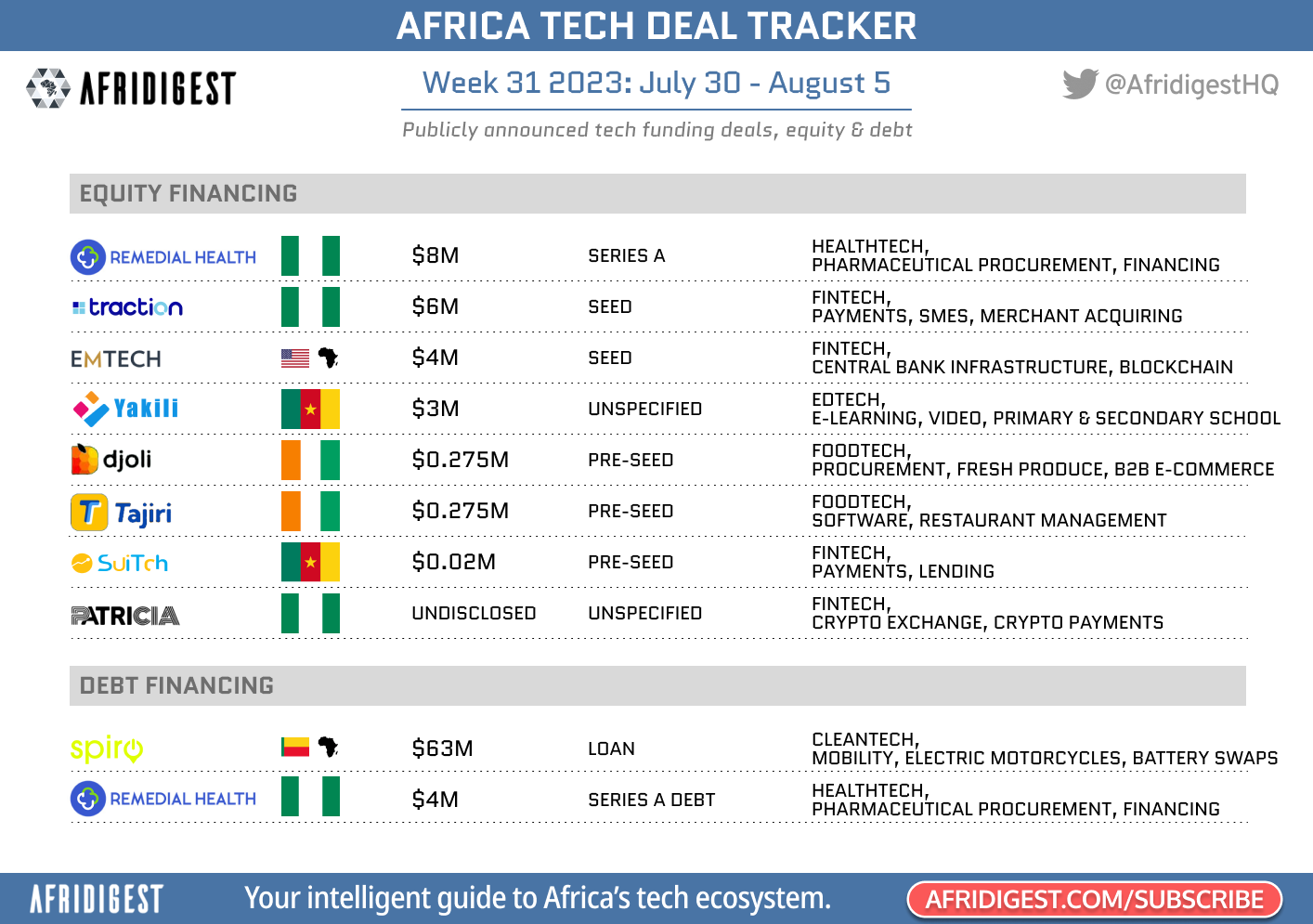

Week 31 2023: July 30 - August 5

NEW ON AFRIDIGEST.COM

40 African tech startups raised ~$140M in July — ICYMI, here’s our recap of tech fundraising activity across Africa last month. We don’t just share the numbers, we show our work. 😉

📢 We accept & are actively calling for op-eds/essays from industry leaders for publication on Afridigest.com. Our focus is on ideas, analysis, and insights that help readers succeed in building the continent's future. Get in touch: submissions@afridigest.com.

🔦 Equity & Debt FundraisesRemember to submit fundraising announcements via the form below:

💰 Investor ActivitySouth African proptech investor REdimension Capital announced the ~$10.7M (ZAR200M) first close of its Real Estate Technology and Sustainability Fund I. LPs include Investec Property Fund, Growthpoint Properties, Rand Merchant Bank, Liberty Two Degrees, Liberty Group and Sphere Holdings. The fund expects a final close by January 2025.

Last week we mentioned that the European Investment Bank was considering a $10M investment in Seedstars Africa Ventures Fund 1. This week, we’re clarifying that this is in addition to the $20M the EIB previously approved for the fund. Thanks to readers who spotted this. 🙏🏽

Africa-focused Japanese healthtech investor AAIC signed an MOU with OurCrowd, Israel’s most active VC investor. The collaboration is focused on knowledge sharing, deal sharing, and portfolio support for the African activities of OurCrowd’s new $200M Global Health Equity Fund.

🕵️♀️ In case you missed itNEWS

Kenya suspended Worldcoin last week as thousands queued for free money. But Worldcoin hoped/hopes to resume iris scans in the country. But this just in a couple of hours ago: Worldcoin’s Nairobi warehouse was raided by Kenyan police.

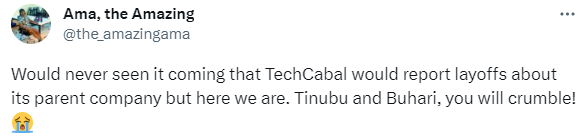

In the latest (public) Africa Tech layoff news, VC-backed media startup Big Cabal Media, parent company of Zikoko and Techcabal, laid off 19% of its staff. The company cited the “business environment” as a key driver, and its subsidiary TechCabal noted that “currency devaluation…changed revenue projections for many Nigerian venture-backed startups.”

OTHER ARTICLES

The BRICS are better off disbanding than expanding (Reuters)

Cyber governance in Africa is weak, taking the Malabo Convention seriously would be a good start (The Conversation)

Why is no one talking about venture building in Africa? (Ventureburn)

Lacina Koné on why African governments must prioritize affordable internet and smartphones (Rest of World)

Spread the love. Share Afridigest with a friend.

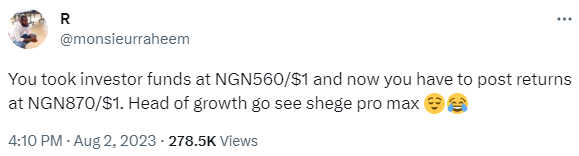

👀 Visual of the WeekAfrica doesn't exist.

At least not as we know it.

The national boundaries we have today were drawn arbitrarily.

Here's a look at the continent if its borders were drawn along historical tribal/ethnolinguistic divides.

Join the conversation on LinkedIn.

(Old school Afridigest readers might remember this visual from Week 48 2021 — we went waaay back in the vaults for this one 😊.)

🐤 Tweets of the WeekOn startup founders, venture capital, and currency devaluation:

Some say comments like this are obvious, but there’s often a lot of value in stating the obvious to a general audience:

ANd here’s a good tweet on why we see a very prominent PayPal mafia and a quiet Google mafia — click through for the video:

Bonus: On Jambo: if you announce a big fundraise but then go quiet, people will will fill in the blanks for themselves. On Worldcoin: free money is free money.

🗣️ Community Corner and Opportunities (Send to submissions@afridigest.com)🎰 OPPORTUNITIES

Partech Africa is hiring a Dakar-based investment analyst intern to start in October 2023.

⏰ Early-stage African fintech, mobility, e-commerce, and talent tech founders are invited to apply before August 9th to the 2023 ARM Labs Lagos Techstars Accelerator program. The program offers $20K in exchange for 6% equity and an optional $100K convertible note.

The last word

💭 Just my thoughtsSorry friends, juggling a few articles & more right now, so nothing interesting to add here this week.

(If you missed it, you can find some early thoughts on domestic card schemes across Africa in the Fintech Review here — article coming soon. And I’m also working on three other pieces I’ve previously teased.)

And thanks to my brother, Moulaye — I’m just about halfway through a social media challenge to post on Twitter for 100 consecutive days. On the other hand, I’m just getting started on the LinkedIn portion of that challenge.

You can follow (or lurk on) my Twitter and LinkedIn pages to see what I’m thinking about.

Tell me what you thought of today’s newsletter:

😡 Hated it • 😑 Meh • 😃 Loved it

And reach me via WhatsApp, Twitter, LinkedIn, or email.

✨ The rest of this newsletter is available to premium subscribers whose support makes this work possible; it contains details on the companies & founders that announced fundraises this week, as well as M&A deals.

If you’re a free reader, consider upgrading your subscription today. Join a discerning group of founders, investors, and executives who enjoy subscriber benefits and support Afridigest’s vision to equip readers to build the continent’s future. ✨